Insights

KR Decarbonization Magazine

VOL.01 | WINTER 2022

Greenhouse Gas Regulation and Choosing the Right Green Fuel

By Lim Sunghwan, Senior Vice President of KR Business Support Team |

Under the ever-changing conditions

|

Deepening Concerns Over Strengthening Environmental Regulations

In the face of the gradual strengthening of environmental regulations, the driving decarbonization of financial and insurance industries, social pressure, and other decarbonization movements, it is not easy to decide which fuel is the main fuel for new builds from the shipowners’ perspective.

In line with this broader trend of new building orders, most dedicated cargo carriers, such as LNG carriers, LPG carriers, and methanol carriers, have decided to use transported cargo as fuel. However, shipowners are being prudent to make the decision to adopt LNG as fuel in the use of container ships, bulk carriers, or tankers, since only approximately 20 percent of those ships are LNG-fuelled ships. This is a tactical strategic plan to invest in changing to a lower carbon fuel after uncertainties are resolved rather than making a preemptive choice in a situation where technologies, regulations, and supply chains have not been resolved.

In the midst of a great change called 'decarbonization', major shipping companies are trying to set a goal to accomplish GHG goals and secure a fuel supply chain between various options such as ordering methanol-propulsion LNG ships. There are various options for alternative fuels, however, the shipping industry has not yet to find the impeccable one to solve all challenges that we have. This means that we need to keep an eye on the latest regulation updates and technology development trends to find an ideal solution for each shipping company.

The Ultimate Alternative Fuels

It is more critical than ever to evaluate the overall economic feasibility, including the possibility of changing regulations when planning to contract newbuilds. In particular, consideration of GHG emissions from the fuel lifecycle perspective, Market-Based Measurement (MBM) including carbon tax and the impact of the EU’s Emission Trading System (ETS) is to be considered.

Shipping companies that choose methanol fuel intend to achieve carbon neutrality by using green methanol from the view of lifecycle assessment, even if the current emission of carbon dioxide emitted from the ship is more than that of LNG. Securing green methanol is an imperative requirement, however, it is not easy to expect ordinary shipping companies to secure green methanol.

The real concern for shipping companies ordering newbuilds at this point is whether to choose LNG fuel now. In the face of decarbonization needs continue to grow, it is time to choose whether to use LNG, a low-carbon fuel that can immediately reduce GHG emissions, or to use conventional fuel and order an alternative-fuel-ready ship to prepare for more advanced green fuels like ammonia.

In the case of ships that need to be built now, if LNG fuel supply chain is available, choosing LNG as fuel may be a better choice, despite the higher initial CAPEX costs. The main reasons for reluctance to use LNG fuel are probably the cost of the initial purchase and the fear of environmental restrictions. However, it is undeniable that LNG is the most viable alternative as other alternative fuels are expected to take a lot of time to become competitive and fully commercialized in terms of cost and responding to regulations.

In terms of cost, LNG application CAPEX was an additional 30% of the price of new ships in the past, but now it has decreased to 10-20% due to increased supply. Considering the production cost, it is expected that the amount will not be go down than it is now. If one decides to retrofit the vessel, it would inevitably cost more compared to new construction. Even looking at the current LNG or LPG fueled vessel, the cost of retrofitting is nearly twice that of the additional cost of newbuilds.

Several regulatory measures are currently being discussed, but the level of regulation on LNG can be estimated through FuelEU Maritime of the "Fit for 55" legislation announced by the EU, which is likely to become a measure of environmental regulation in the global shipping sector. FuelEU Maritime is a regulation that restricts the GHG emission ratio for each fuel according to the fuel's lifecycle emission standard. Under the regulation, LNG propulsion ships are expected to be fine-free for a limited period of time. This shows that low-carbon alternative fuels such as LNG are regarded as transitional fuels and allowed to be used from a mid-term perspective, and the use of renewable energy-based carbon-free alternative fuels is required from a long-term perspective.

It is true that some argue the use of LNG is not an eco-friendly fuel considering methane slip and the LNG production process. However, in response to these criticisms, innovative projects have been proposed to convert LNG into bio-LNG or synthetic LNG, which are carbon-neutral fuels, from the perspective of supplying LNG to the entire lifecycle of the vessels.

Nevertheless, if LNG fuel is not able to be applied during the construction of new ships due to various circumstances, choosing an alternative fuel-ready ship is the next best option. In this process, it should be noted that the alternative fuel readiness level should be practical enough to minimize additional costs for retrofitting.

Besides, technically applicable energy saving devices such as wind assist propulsion systems, air lubrication systems, and waste heat recovery systems that can reduce the use of expensive alternative fuels as much as possible, should be actively considered. For optimal operation, measures like route management, and hull cleaning also be undertaken. After properly integrating and applying all these technologies, it is believed that applying the most competitive alternative fuels is the right path the shipping industry should take to decarbonize shipping.

Collaboration in the Era of Decarbonization

Stringent requirement and strengthening regulation for decarbonization are inevitable. As they go through energy transition, shipowner and yard concerns are getting deeper and deeper. Regulations, the economy, maritime trade volumes, the direction of the energy industry's development, and the level of technological development, are all uncertain. To overcome these uncertainties and secure competitiveness in the era of decarbonization, close cooperation between maritime stakeholders is more critical than ever. To meet these needs, KR is also working closely with the maritime sector and carrying out research and development in various fields. We have been performing joint research projects with major shipbuilders on ammonia-propulsion ships, hydrogen carriers, biofuels and various alternative fuels, participation in state-led research projects, and establishing rules and standards for the latest technologies. As a close maritime sector partner KR will support maritime stakeholders in choosing the right green fuels and responding to the uncertainties of a greener future together.

Marine Fuel and Life Cycle Assessment

By. HA Seungman Senior Surveyor of KR International Relations Team |

Life Cycle Assessment,

|

Life Cycle Assessment

As the international maritime industry moves toward carbon neutrality, the use of alternative fuels for ships is expected to increase over the next few years. This will lead to rising demand for the use of biofuels along with zero-carbon fuels such as ammonia, hydrogen, and electric propulsion.

However, when evaluating the 'eco-friendliness' or 'sustainability' of these alternative fuels from a life cycle perspective, they may have a more negative impact on the environment compared to conventional fuels, depending on the fuel production method. For example, hydrogen produced by the natural gas reforming method is evaluated negatively than conventional fuels such as HFO because it emits a larger amount of greenhouse gas (GHG) emissions during the fuel production process. The current IMO's ship energy efficiency indexes, EEOI, AER, EEDI and EEXI, have limitations in assessing the sustainability and comprehensive environmental impact of marine fuels since they only consider GHG emitted by the fuel oil used on board ships.

A Life Cycle Assessment (LCA) involves quantifying the amount of energy and materials consumed and emitted (e.g., GHG emissions) throughout the life cycle of a product or process to determine their environmental impacts and evaluate them comprehensively to improve the environment. The life cycle can be described as a Well-to-Wake (WtW) process, which combines Well-to-Tank (WtT) process and Tank-to-Wake (TtW) process. In the WtT process, for example, HFO is obtained as follows. First, crude oil is extracted from the production area. It is then transported domestically via oil carriers, processed and refined into HFO at oil refineries. After the processing and refining stage, HFO is distributed through pipelines to bunkering ships or onshore bunkering facilities. For the TtW process, the final stage of the process covers using the bunkered HFO in the vessel as fuel.

In the case of an electric propulsion ship, for the WtT process, firstly raw materials, such as coal and natural gas, produced through extraction, processing, and transportation, are supplied to the power plant. Secondly, the generated electricity is transmitted, distributed and charged on the ship. In the TtW process, the electricity produced is directly used onboard.

LCA can comprehensively evaluate the environmental performance and sustainability of fuels by evaluating various environmental impacts in other categories, such as resource consumption, ozone layer depletion, photochemical oxide production, eutrophication, and acidification in addition to the global warming impact caused by greenhouse gas emissions.

Carbon Neutrality and LCA-Based Approach

Decarbonization and carbon neutrality are becoming unavoidable norms not only in international shipping but also globally. In order to assess the eco-friendliness of carbon neutrality, an LCA-based approach is required to identify and improve the particular stage of the process that requires high energy consumption and pollutant emissions. The LCA-based approach is being used widely in various fields, including the UN Sustainable Development Goals (UNSDGs), Environmental, Social, and Governance (ESG) measures, and Carbon Border Tax, with highlighted significance for future applications, including sustainability evaluation. A notable example of an LCA-based approach can be found in the establishment of the Green Shipping Corridor for carbon neutrality, which was attempted through the Clydebank Declaration at the 26th United Nations Framework Convention on Climate Change (COP 26), and the updated pledges made in the Green Shipping Challenge at COP 27.

The 2021 United Nations Climate Change Conference (COP 26)

© UNclimatechange (www.flickr.com/photos/unfccc)

The IMO also recognized the limitations of the evaluation scope for current Ship Energy Efficiency Indexes and decided to develop the “Lifecycle GHG and carbon intensity guidelines for marine fuels” as a short-term measure in an initial strategy for the reduction of GHG emissions from ships to encourage the uptake of sustainable alternative fuels. Through this work, IMO plans to develop a methodology and guidelines for quantifying GHG emissions from marine fuels during the “Well-to-Wake” process.

At the beginning of the IMO discussion, some member states were reluctant to introduce the LCA framework into IMO instruments because it was beyond the scope of international shipping. Currently, the most relevant stakeholders understand the necessity and importance of reducing GHG emissions based on an LCA-based approach and are actively developing the relevant guidelines. It should be noted that the sulfur content regulation, which took effect in 2020, is similar to the LCA framework in that it can be considered as a regulation outside the scope of international shipping because onshore fuel suppliers must supply fuel that meets the sulfur content regulation.

The Impact of Developing ‘GHG Lifecycle and carbon intensity guidelines for marine fuels’

Currently, the IMO has set up a Correspondence Group to develop and finalize the draft LCA guidelines by July 2023. The guidelines are expected to cover default WtT and TtW emission factor values for each fuel and a certification system with the use of enhanced emission factor values. Along with the development of guidelines, a robust discussion on the application of emission factor values to IMO regulations will also take place.

The life cycle GHG assessment of marine fuels will have a significant impact on the selection of future fuels, depending on the outcome of the discussion on the development of the LCA guideline and whether it can be combined with the upcoming basket of GHG measures for the decarbonization of international shipping sector. Taking into account that the implementation of GHG lifecycle emission regulations will have a profound impact on the shipping industry, such as increasing fuel costs, KR has been coordinating closely with the relevant stakeholders to support and develop the regulatory frameworks, new technologies and classification notations for the introduction of sustainable marine fuels.

Introduction of EU Fit for 55 and Strategic Decarbonization Measures

By. KIM Jinhyung, Principal Surveyor of KR Machinery Equipment Research Team |

Progress after the announcement

|

EU Fit for 55 package legislation to meet European climate law targets

Following the European Green Deal proposal, the European Commission (EC) announced the EU Fit for 55 package bill in July 2021. Fit for 55 refers to a package of several legislative proposals applied to various industries to achieve the mid-term reduction target of European climate law (at least 55% reduction by 2030 compared to 1990). The legislative proposals of the Fit for 55 package that relate to the shipping sector are the European Union's Emission Trading Scheme (ETS) and the use of renewable and low-carbon fuels in maritime transport (FuelEU Maritime).

EU ETS: Another challenge for the shipping industry

The EU ETS is a system in which allows to buy or sell the emission permits for greenhouse gas (GHG) emissions. So far, the EU ETS has been applied to land-based installations since 2005 and the aviation industry since 2012. As one of the EU ETS revision proposals for the Fit for 55 package, maritime shipping emissions will be included in the EU ETS from 2024. The EU Commission, Parliament, and Council have been discussing revisions to the EU ETS through Trilogues. It is expected that consensus will be achieved and a revision adopted at the end of 2022 or early 2023.

The task of the EU ETS

© EU Council

EU ETS applies to greenhouse gas (CO2, CH4, N2O) emissions from ships of 5,000 GT and above calling at EU ports. Unlike the method applied to other existing industries, all emission permits corresponding to GHG emissions generated while calling at an EU port must be purchased and surrendered to the EU authorities. In other words, it is a regulatory structure based on the polluter pays principle. The regulated of GHG emissions is calculated 50% of emissions from extra-EU voyage and 100% of emissions from intra-EU voyage from 2024, and 100% of emissions from all EU voyage from 2027.

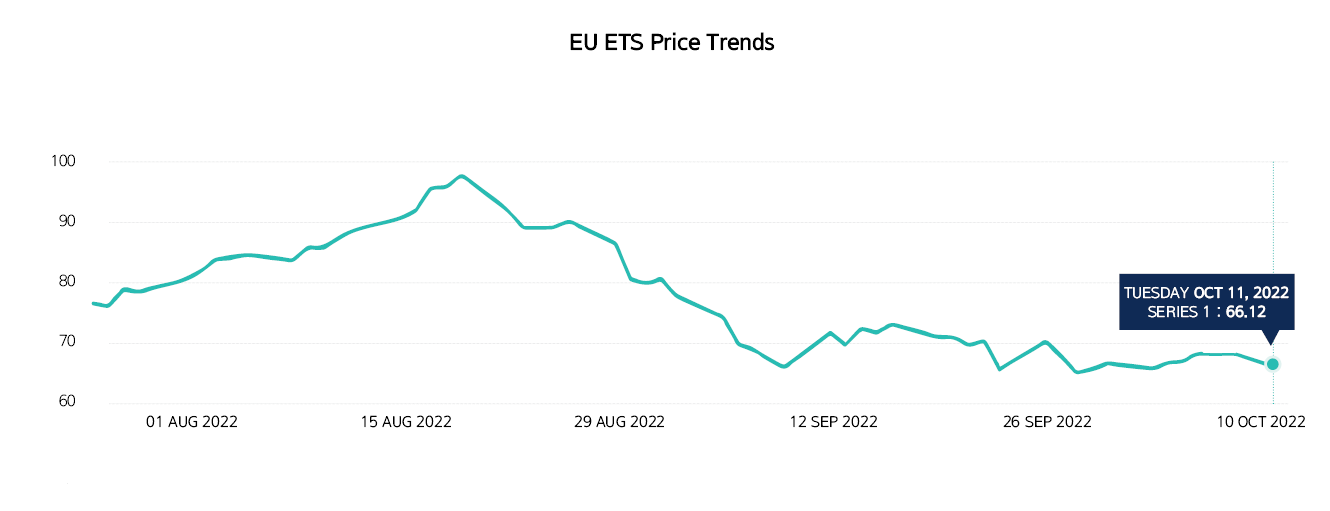

Emissions allowances can be traded at the emission trading exchange or via direct trading, with 1 tonne of GHG (tonne CO2eq) being the unit of transaction. The price of emission permits has price fluctuation due to various factors such as supply and demand. The price of EU emission permits is traded at about 66 euros as of 11 October 2022. If one fails to surrender emission permits, this will result in a fine of 100 euros per tonne corresponding to the un-surrendered emissions, and must be surrendered as part of emission permit applications in the following year.

© ICE(Intercontinental Exchange)

According to EU MRV report data in 2021, the 12,131 vessels worldwide are subject to EU ETS. Their emissions are estimated to be 82 million tonnes based on 50% of emissions from extra-EU voyage and 100% of emissions from intra-EU voyage, and 125 million tonnes based on 100% of emissions from all EU voyages. Based on this, if 66 euros per tonne of emission permit price is applied, it is estimated that the cost will be 5,440 million euros per year for emissions of 82 million tonnes, and 8,220 million euros per year for emissions of 125 million tonnes.

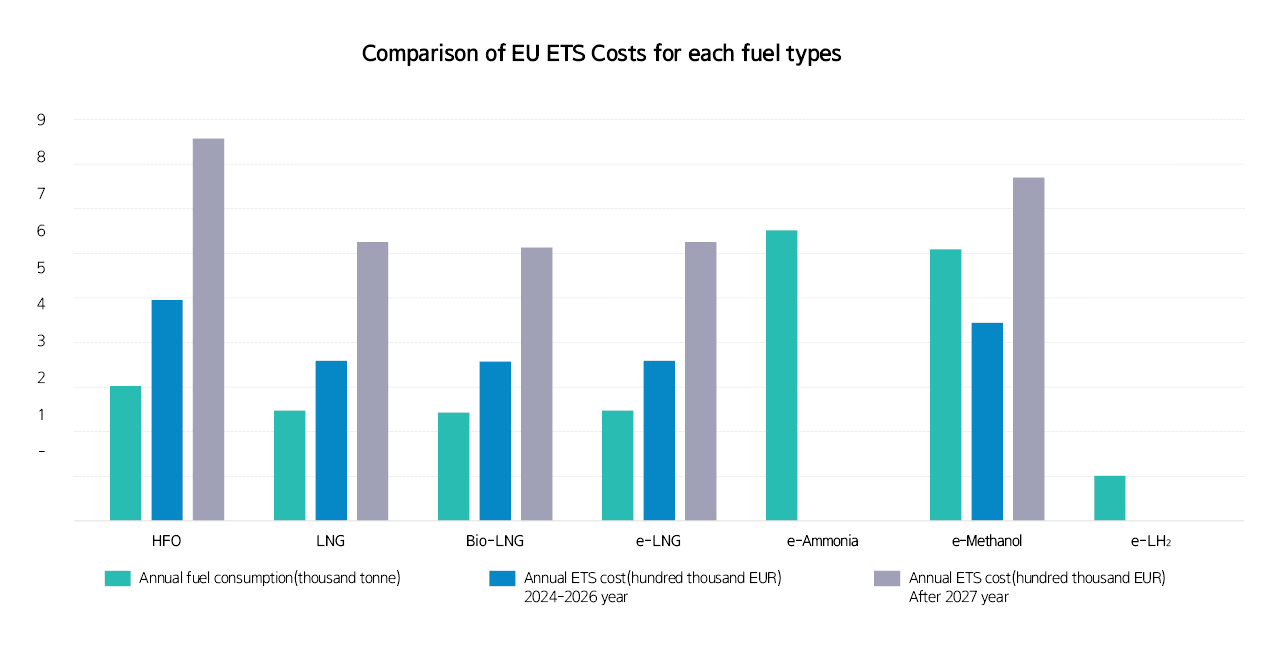

We analyzed the economic feasibility of the cost of credits following the introduction of alternative fuel vessels with the same criteria. The analysis method is as follows:

First, the annual consumption of each fuel was derived by applying the calorific value of each comparative fuel based on a ship using 3,000 tons of HFO per year. And based on this, by applying the CO2 emission factor for each fuel, the CO2 emissions are calculated based on 50% of emissions from extra-EU voyage and 100% of emissions from intra-EU voyage. If the cost of emission permits for each fuel is calculated by applying 66 euros per tonne, the cost of each emission permit is as shown in the following graph. It will be possible to calculate the overall economic feasibility based on the cost of alternative fuels and the cost of alternative ships powered by alternative fuels based on the analysis.

© EU Parliament

FuelEU Maritime: The beginning of mandatory use of green fuel

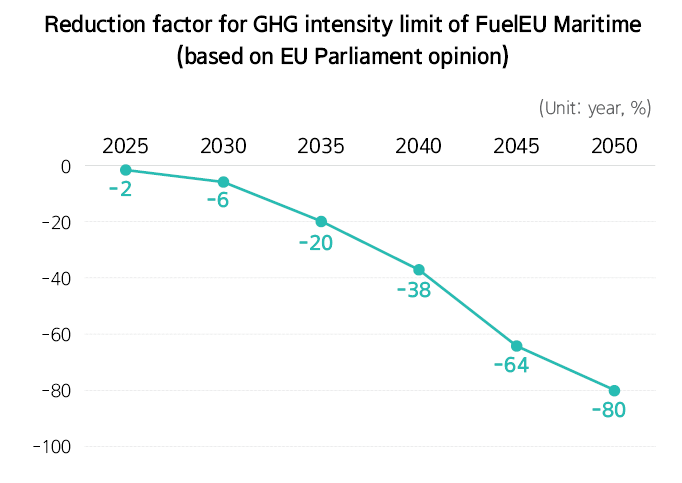

FuelEU Maritime, which is expected to come into effect in 2025, is a legislative initiative designed to create new regulations on the use of renewable or low-carbon fuels in maritime transport. Its goal is to stimulate the demand for eco-friendly ship fuel by gradually increasing the limit on GHG emissions intensity of ships calling at EU ports by 2050.

The GHG emissions intensity represents GHG emissions per mega joule calculated based on the whole process emission (Well-to-Wake, WtW), which includes emissions from the process of fuel production to supply (Well-to-Tank, WtT) and the process of using the fuel (Tank-to-Wake, TtW).

In the case of using fuel with a higher intensity than the GHG intensity limit, the penalty is calculated considering the difference between GHG intensity of fuel types used by the vessel and the GHG intensity limit, the fuel consumption and the specified penalty. The intensity limit will be strengthened every five years from 2025.

As of October 2022, the EU Parliament plenary has approved the FuelEU Maritime legislation. Trilogues with the EU Commission, Parliament and the Council will be held accordingly. Based on the proposal of the European Parliament plenary session, the reduction target for GHG intensity limit will be -2% from 2025, -6% from 2030, -20% from 2035, -38% from 2040, -64% from 2045, -80% from 2050 based on the 2020 EU MRV reference value. In addition, from 2030, it is mandatory to use Renewable Fuels of Non-Biological Origin (RFNBO) up to 2% of a ship's total energy consumption. Moreover, container and passenger ships are required to connect on-shore power supply or use zero-emission technologies when a ship at berth in a EU port of call for more than two hours.

© EU Parliament

Time to prepare for a comprehensive decarbonization response

Based on the two regulations cited above, it is clear that the shipping sector must prepare for the transition to carbon neutral and the time to make a strategic decision is rapidly approaching. In order to respond to the Fit for 55 regulations, it is necessary to make arrangements for the transition to a future green ship, such as using ammonia and methanol as fuel. Furthermore, one must think beyond simply building an eco-friendly ship to make these vessels compliant. It is necessary to establish a comprehensive strategy that takes into account various factors such as achieving mid-to long-term decarbonization reduction targets throughout the pre-production, manufacturing and in-use phase; the life cycle of a ship; the price of alternative fuels; supply stability; and whether to build infrastructure. In addition, in order to effectively respond to financial measures, such as the emission trading system, it is necessary to consider a financial strategy that breaks away from the traditional regulatory response method and enhance response capabilities comprehensively.

Above all, the participation and collaboration of stakeholders from each sector is needed. Decarbonization is a challenge for many shipping companies. Collaboration of maritime stakeholders, including individual shipping companies, shipyards and classification societies will have a more significant impact than individual shipping companies going it alone.

KR has been continuously analyzing Fit for 55's impact, as well as developing technical solutions through collaborations with maritime leaders, to achieve decarbonization. Our recent accomplishments with joint research projects with major shipyards, ship owners, and energy companies have led to the commercialization of alternative fuel vessels and propulsion systems, including liquefied CO2 carriers, methanol dual-fuel vessels and ammonia-powered very-large gas carriers (VLGCs).

In addition, KR is attempting to establish a collaborative system between industries through a wide range of technical services, such as EEXI/CII response simulations, carbon-emission information and cost management solutions to implement EU ETS regulations to support the integration of international/regional GHG regulations.

The technological transition toward carbon neutrality is no longer a choice, but an inevitable and obvious challenge of our era. The time has come to consider the right approach and its speed before taking action. Despite the regulatory, technical and economic uncertainties that may seem overwhelming, the EU and the international community remain committed to decarbonizing shipping. In this regard, we need to prepare for a comprehensive and flexible decarbonization response through close collaboration of maritime stakeholders.