Insights

KR Decarbonization Magazine

VOL.08 | AUTUMN 2024

2024 IMO DCS/CII

Verification Results and Status

Kim Jinhee, Senior Surveyor of Green Ship Technology Team

|

The CII(Carbon Intensity Indicator) regulation, applying to ships engaged in international voyages of 5,000 GT and above, is enforced under Regulation 28 (Operational Carbon Intensity) of Annex VI of MARPOL(the International Convention for the Prevention of Pollution from Ships ) adopted by the IMO. The first verification under this regulation took place in 2024. The CII, representing a ship’s GHG emissions, is derived from reported and verified operational data in compliance with Regulation 27 (Collection and reporting of ship fuel oil consumption data) of MARPOL Annex VI.

Under the CII regulation effective since November 2022, ships subject to this regulation collected and reported their operational information for the period from January 1 to December 31, 2023. The CII values and ratings for each vessel were determined based on the reported data, with ratings assigned from A to E according to the IMO's CII rating criteria.

KR conducted the verification and certificate issuance this year through its GHG reporting and verification system for ships, KR GEARs. The following summarizes the current status of the verified CII ratings.

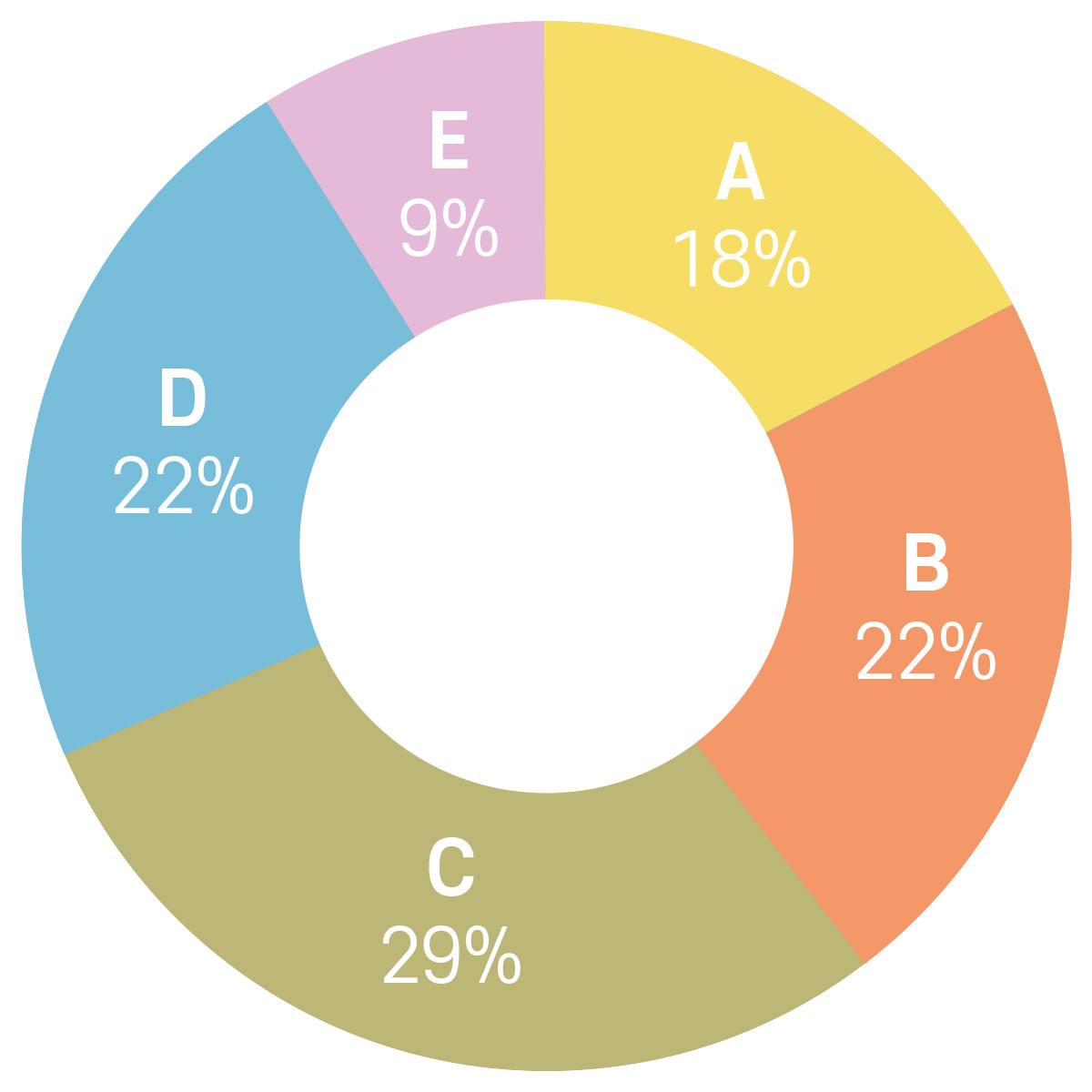

CII verification results of 2024

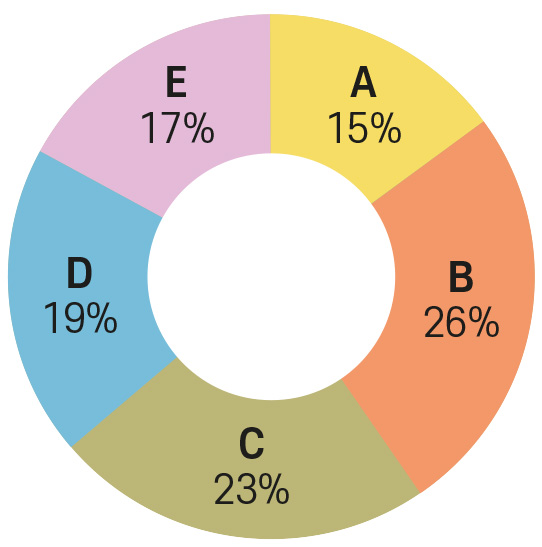

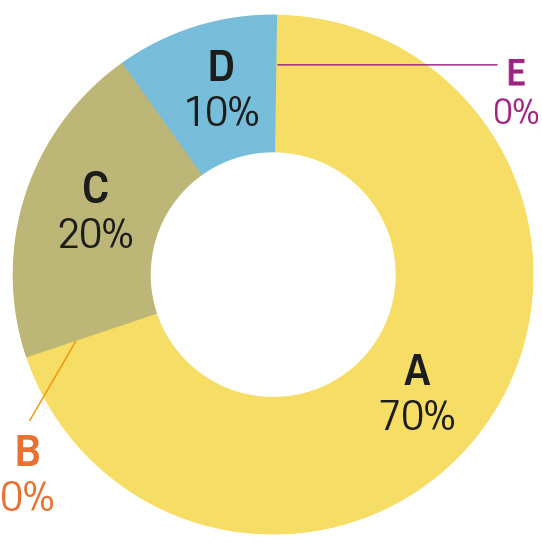

In compliance with IMO Regulation, KR verified a total of 1,652 ships by July 2024, of which 1,374 ships were subject to the CII regulation. The distribution and percentages of CII ratings across all verified ships are outlined below.

| Rating | A | B | C | D | E |

|---|---|---|---|---|---|

| Number of Ships | 241 | 303 | 397 | 308 | 125 |

CII Rating Status of All verified Ships

Additionally, by analyzing the results by ship type, the vessels were classified into 12 categories*. Ro-Ro cargo ships (vehicle carriers), Ro-Ro cargo ships, and Ro-Ro passenger ships were grouped under "Ro-Ro ships," while combination carriers and refrigerated cargo carriers were categorized as "Other ship types." The distribution of verified vessel types under the CII regulation is shown below.

* Ship type subject to CII regulation : Bulk Carrier, Gas Carrier, Tanker, Container Ship, General Cargo Ship, Refrigerated cargo Ship, Combination carrier, LNG Carrier, Ro-Ro cargo ship(vehicle carrier), Ro-Ro cargo ship, Ro-Ro Passenger Ship, Cruise passenger Ship with non-conventional propulsion

| Ship Type | Number of Ships | Proportion |

|---|---|---|

| Container Ship | 267 | 19% |

| Bulk Carrier | 462 | 34% |

| Tanker | 360 | 26% |

| LNG Carrier | 47 | 3% |

| GAS Carrier | 52 | 4% |

| General Cargo Ship | 71 | 5% |

| RO-RO Ship | 105 | 8% |

| Other Ship (Combination Carrier, Refrigerated Cargo Carrier) |

10 | 1% |

| Total | 1,374 | 100% |

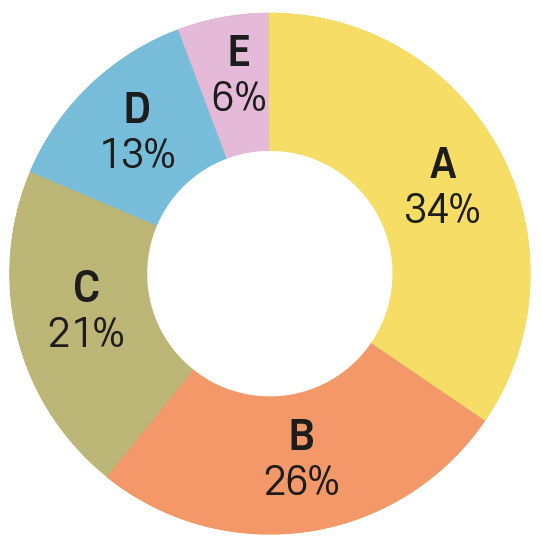

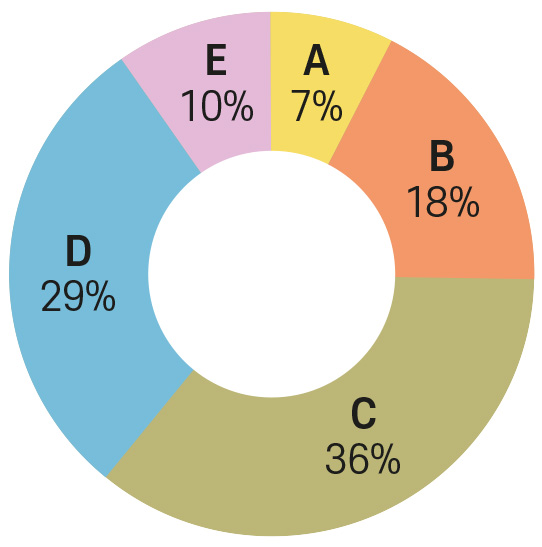

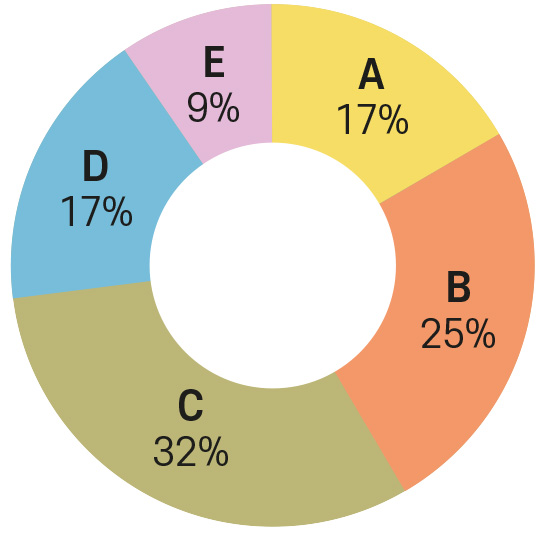

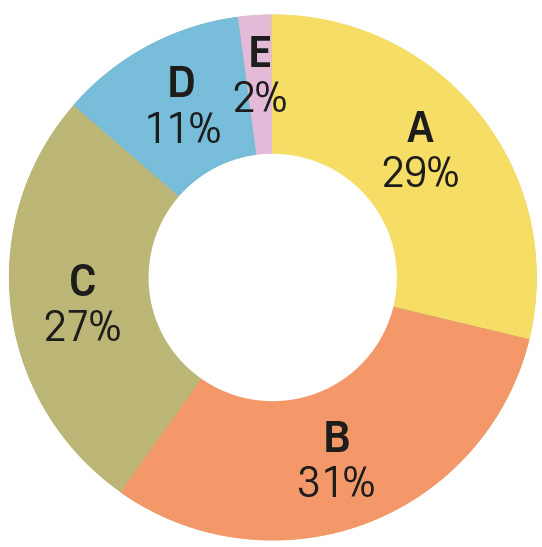

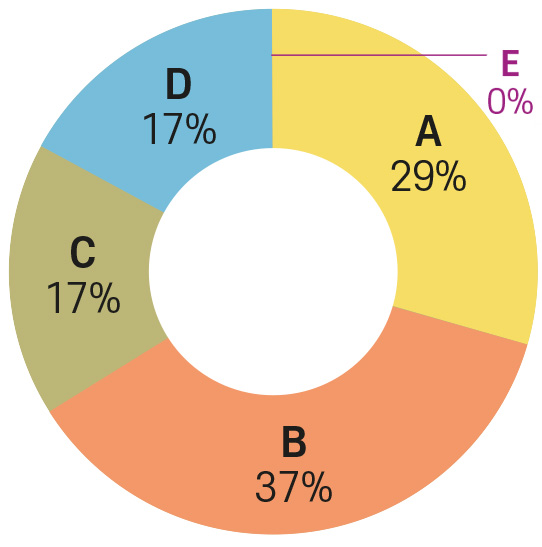

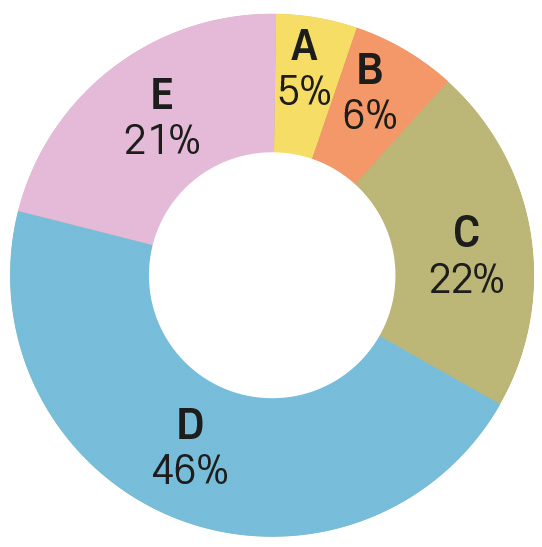

And the following charts display the proportions of CII ratings for each ship type.

Container Ship

Bulk Carrier

Tanker

LNG Carrier

GAS Carrier

General Cargo Ship

RO-RO Ship

Other Ship

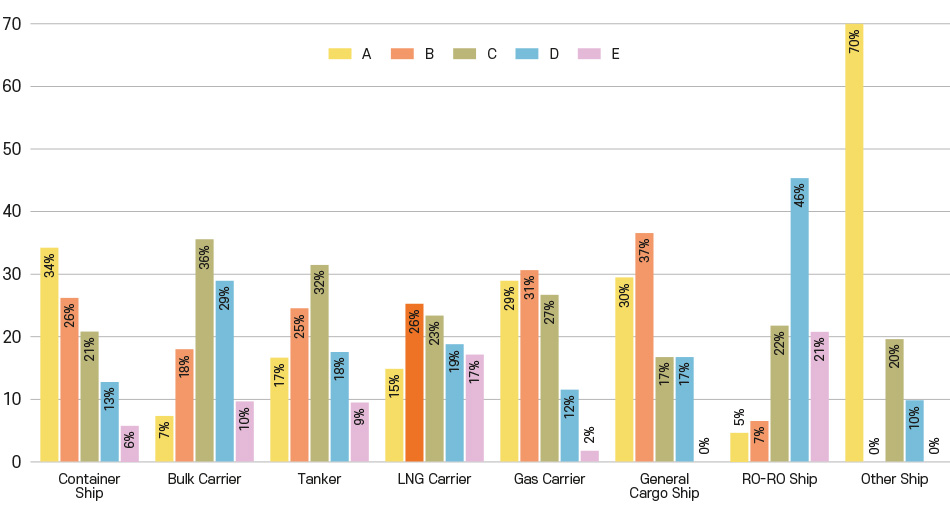

The graph below compares the distribution of CII ratings across different ship types.

CII Rating Distribution by Ship Type

KR’s verification results for CII ratings showed a ratio of 4:6 between high ratings (A~B) and low ratings (C~E). An analysis by ship type reveals that over 50% of the ships for Container Ships, Gas Carrier, General Cargo Ships had high ratings. By contrast, bulk carriers and Ro-Ro ships demonstrated a higher proportion of low ratings, with 75% of bulk carriers and 89% of Ro-Ro ships falling into the low-rating categories.

Comparison with 2023 IMO DCS Verification Results

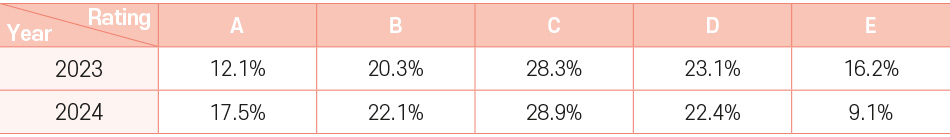

To assess the 2024 CII values and ratings, a comparison was made with the IMO DCS data from 2023. The 2023 data was adjusted using the same reduction rates applied in 2024 to enable a direct comparison of the CII rating distribution.

A comparison of the overall CII rating distribution indicates a decrease in the number of ships rated E in 2024 compared to 2023.

And the table below compares high and low CII rating distributions by ship type.

| YEAR | 2023 | 2024 | ||

|---|---|---|---|---|

| A~B | C~E | A~B | C~E | |

| Container Ship | 44% | 56% | 61% | 39% |

| Bulk Carrier | 26% | 74% | 25% | 75% |

| Tanker | 39% | 61% | 41% | 59% |

| LNG Carrierr | 41% | 59% | 40% | 60% |

| GAS Carrierr | 53% | 47% | 60% | 40% |

| General Cargo Ship | 57% | 43% | 66% | 34% |

| RO-RO Ship | 9% | 91% | 11% | 89% |

| Other Ship | 80% | 20% | 70% | 30% |

Container ships, general cargo ships, and gas carriers saw an increase in the proportion of high CII ratings in 2024 compared to 2023. Conversely, bulk carriers, tankers, LNG carriers, and Ro-Ro ships showed little change in rating distribution.

Additionally, a comparison of average ship speed per year* by ship type for the 2023 and 2024 data revealed that, with the exception of LNG carriers and general cargo ships, all ship types experienced a speed reduction in 2024 compared to 2023.

*Distance traveled per year/ hours traveled per year, Unit : NM/Hour

| Ship Type | 2023 | 2024 | Difference |

|---|---|---|---|

| All Ships | 11.84 | 11.93 | ↑0.09 |

| Container Ship | 13.31 | 12.70 | ↓0.61 |

| Bulk Carrier | 11.02 | 11.02 | - |

| Tanker | 11.05 | 11.03 | ↓0.02 |

| LNG Carrierr | 14.11 | 15.18 | ↑1.07 |

| GAS Carrierr | 13.61 | 13.55 | ↓0.02 |

| General Cargo Ship | 10.25 | 10.44 | ↑0.19 |

| RO-RO Ship | 15.73 | 14.77 | ↓0.96 |

| Other Ship | 13.29 | 12.93 | ↓0.36 |

General review of CII Verification Results and Status

Since this is the first year of CII regulation enforcement, there have been limited cases of adopting low-carbon fuels, such as biofuels, or implementing energy-saving technologies and GHG reduction technologies, largely due to practical challenges.

Analysis of data from 2023 and 2024 showed that the proportion of high-rated ships (A or B) increased by approximately 7%, while the proportion of E-rated ships decreased compared to the previous year. Vessels assigned an E rating in CII verification for a single year are required to implement improvement measures within their SEEMP (Ship Energy Efficiency Management Plan) Part III, which is subject to verification by a classification society. Fewer vessels belonged to E rating in 2024 than in 2023, likely due to efforts to mitigate administrative burdens and ensure compliance with the regulations.

Upon reviewing CII ratings by ship type, the distribution for most ship types, except for container ships and general cargo ships, remained similar in 2024 compared to 2023. This outcome suggests that the unique operational characteristics of each ship type should be considered when assessing their CII performance.

For container ships, the proportion of high CII ratings (A or B) increased from 44% in 2023 to 61% in 2024. An examination of the reported data, based on the assumption that the improvement results from ship speed optimization, indicated a reduction of approximately 4.6% in speed compared to 2023. In contrast to regular liner ships, such as container ships, bulk carriers often face extended port waiting times, leading to shorter voyage distances, which negatively impact their CII values.

Ro-Ro ships, particularly Ro-Ro cargo ships (vehicle carriers), continue to report a high proportion of lower CII ratings (C, D, E). These ratings reflect the economic challenges inherent in their operations, often driven by shippers’ requirements or loading schedules. Despite a reduction in operating speeds in 2024 compared to 2023, these vessels still require relatively high speeds due to their operational demands, which contributes to the lower ratings.

LNG carriers and gas carriers, sharing operational similarities with Ro- Ro ships, may also be subject to lower CII ratings due to their operational profiles. However, as they primarily use LNG, which has a lower emission factor than conventional fossil fuels (HFO, LFO, MG/MDO), their CII ratings generally outperform those of Ro-Ro ships.

Apart from ten vessels verified in 2024 that used low-carbon fuels (biofuels), there were limited instances of implementing optimal measures to improve CII ratings. With CII standards tightening each year, ships currently rated C may fall to a D rating in the coming years if operational data remains unchanged. This underscores the growing need for vessels to develop and implement action plans to achieve regulatory compliance. Therefore, it is essential for the maritime industry and related sectors to closely monitor regulatory compliance by analyzing annual CII rating trends.

Navigating Towards a Clean Energy Era:

The Core Technologies

of Liquid Hydrogen Carriers

ROH Giltae, Principal Surveyor of Alternative Fuel Technology Research Team

|

Introduction

Green hydrogen offers a sustainable alternative to fossil fuels and is expected to play a pivotal role in the decarbonization of various industries. However, due to regional differences in its production costs, intercontinental maritime transportation of green hydrogen is inevitable. Consequently, the demand for liquid hydrogen carriers is also projected to continuously increase. According to a report published by the International Energy Agency (IEA) in 2023, the cumulative number of liquid hydrogen carriers is expected to reach approximately 200 by 2050.

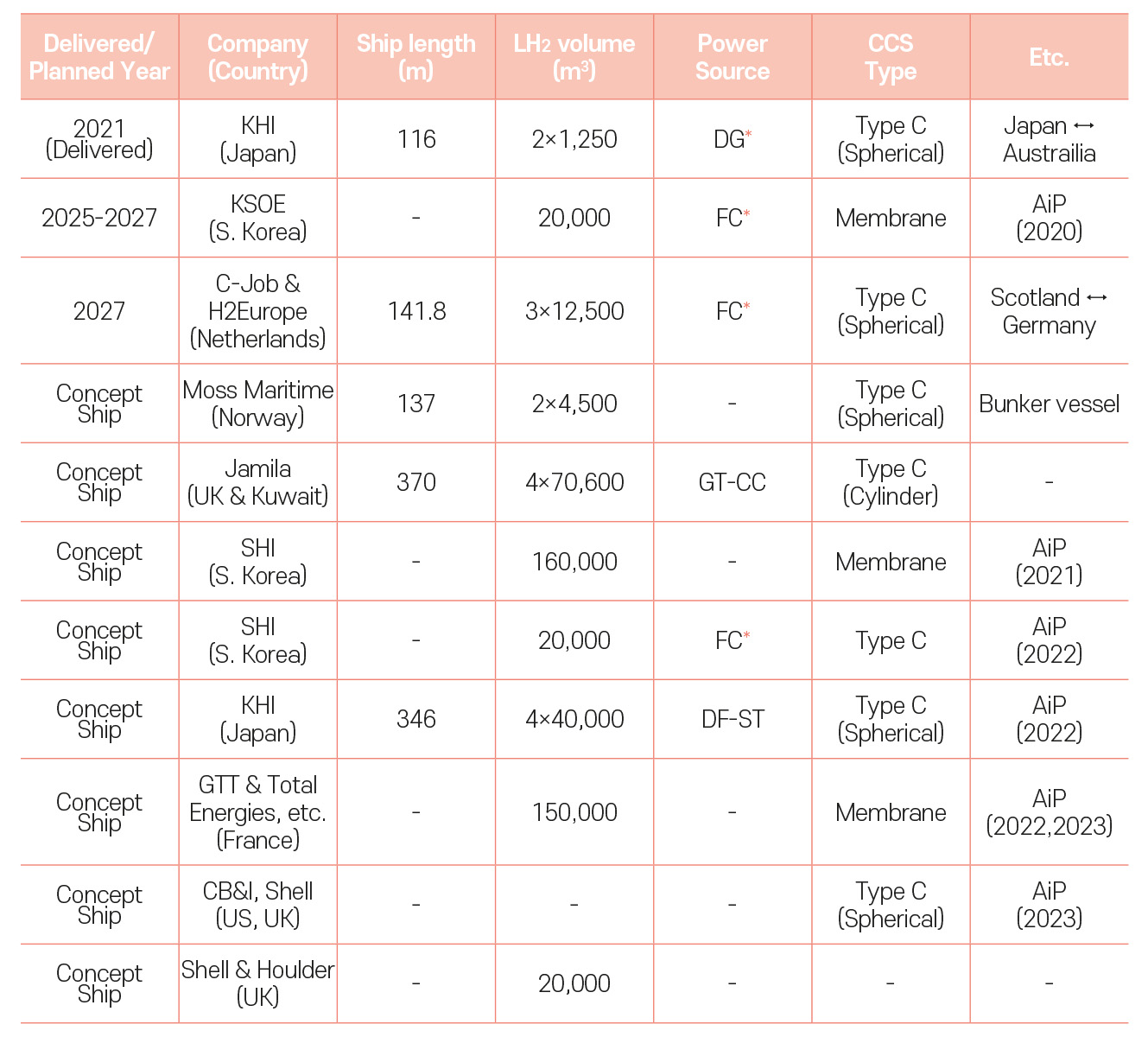

According to the growing global demand for hydrogen, Japan's "Hydrogen Frontier" has garnered attention as a notable first demonstration of a liquid hydrogen carrier. This vessel is designed to transport liquefied hydrogen from Australia to Japan and commenced its first voyage in December 2021. Leading the way with ‘Hydrogen Frontier’, various countries around the world are currently engaged in the R&D, and demonstration of liquid hydrogen carriers. (See Table)

This article will first describe the differences between liquid hydrogen carriers and conventional LNG carriers. Then, it will provide an overview of the current status and considerations for key technologies for liquid hydrogen carriers.

Development Status of Domestic and International Liquid Hydrogen Carriers

* Electric Propulsion Ship

Source: Int. J. Hydrogen Energy, 2024

※ Note. DG: Diesel generator, FC: Fuel Cell, GT-CC: Gas-Turbine Combined-Cycle, DF-ST: Dual-Fuel Steam Turbine.

Japan's Suiso Frontier:

The World's First Liquid Hydrogen Carrier

Concept of Liquid Hydrogen Carrier by

C-Job Naval Architects & LH2 Europe

Concept of Liquid Hydrogen Carrier

Under Development by KSOE

Concept of a 150k-Class Liquid Hydrogen Carrier

Under Development by GTT and Total Energies

Source: HESC, 2020 / Source: C-Job, 2022 / Source: KSOE, 2021 / Source: GTT, 2024

Differences from LNG Carriers

Although liquid hydrogen carriers and LNG carriers utilize similar technical approaches, the distinct characteristics of their cargoes necessitate different design and operational technologies. These differences arise primarily from the physical and chemical properties of hydrogen (H2) and methane (CH4). The key differences are as follows:

| Temperature & Pressure Control |

Liquid hydrogen must be maintained at a much lower temperature (-253°C) compared to LNG (-162°C) to remain in its liquid state. This necessitates advanced insulation and cryogenic technologies beyond those used in LNG carriers. |

|---|---|

| Cargo Tank Design |

For storing liquid hydrogen, currently applicable commercial technologies primarily use vacuuminsulated tanks or compressed C-TYPE tanks. However, for storing large volumes of hydrogen, similar to LNG, membrane tanks are more suitable. Research on cargo containment technology related to this is being conducted both domestically and internationally. |

| Safety and Environmental Regulation |

The natural gas in LNG carriers is heavier than

hydrogen and can linger in the air longer if leaked,

posing an explosion risk, making safety measures

crucial. In contrast, hydrogen is very light and highly diffusive, allowing it to disperse quickly into the atmosphere in the event of a leak. However, it still poses explosion and fire risks when concentrated, necessitating special safety measures and standards to be met. |

Key Technologies of Liquid Hydrogen Carriers

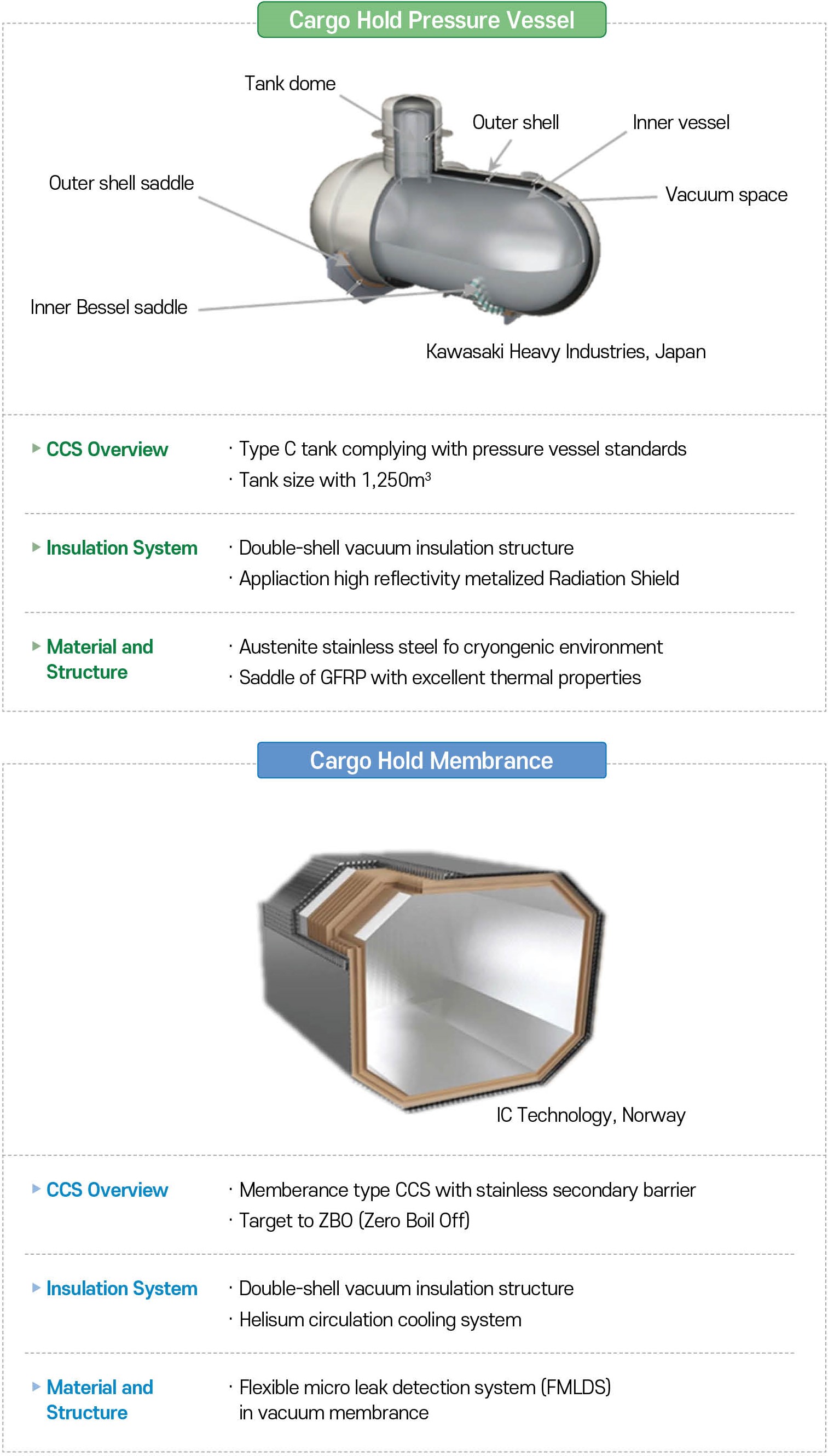

Cargo Containment System (CCS)

Liquid hydrogen carriers primarily use compressed C-TYPE tanks and membrane tanks for cargo containment. These two types of tanks are designed to meet different operational environments and requirements, with the main technical differences outlined below.

| Independent Tanks Type C |

C-TYPE tanks are cylindrical or spherical tanks capable of withstanding pressure, designed to store liquids or gases in high-pressure states. The walls of C-TYPE tanks have a double structure composed of vacuum and insulation materials, minimizing thermal loss. These tanks effectively reduce boil-off rates of liquid hydrogen by blocking thermal exchange through their own vacuum space. However, they are not well-suited for transporting large volumes of cargo due to spatial constraints. |

|---|---|

| Membrane Tank | Membrane tanks are designed to prevent direct contact with the liquid by lining the interior with a flexible membrane, allowing the tank to adapt to the thermal expansion of the liquid. Typically structured in layers, each layer is optimized for the storage conditions of liquid hydrogen, providing thermal and mechanical properties. These membrane tanks can be adjusted to fit the shape of the carrier’s cargo hold and can freely expand and contract, making them suitable for transporting large volumes of liquid hydrogen. |

Types of Representative Cargo Containment Systems

for Liquid Hydrogen Carriers

Source: PNU Hydrogen Ship Technology Center

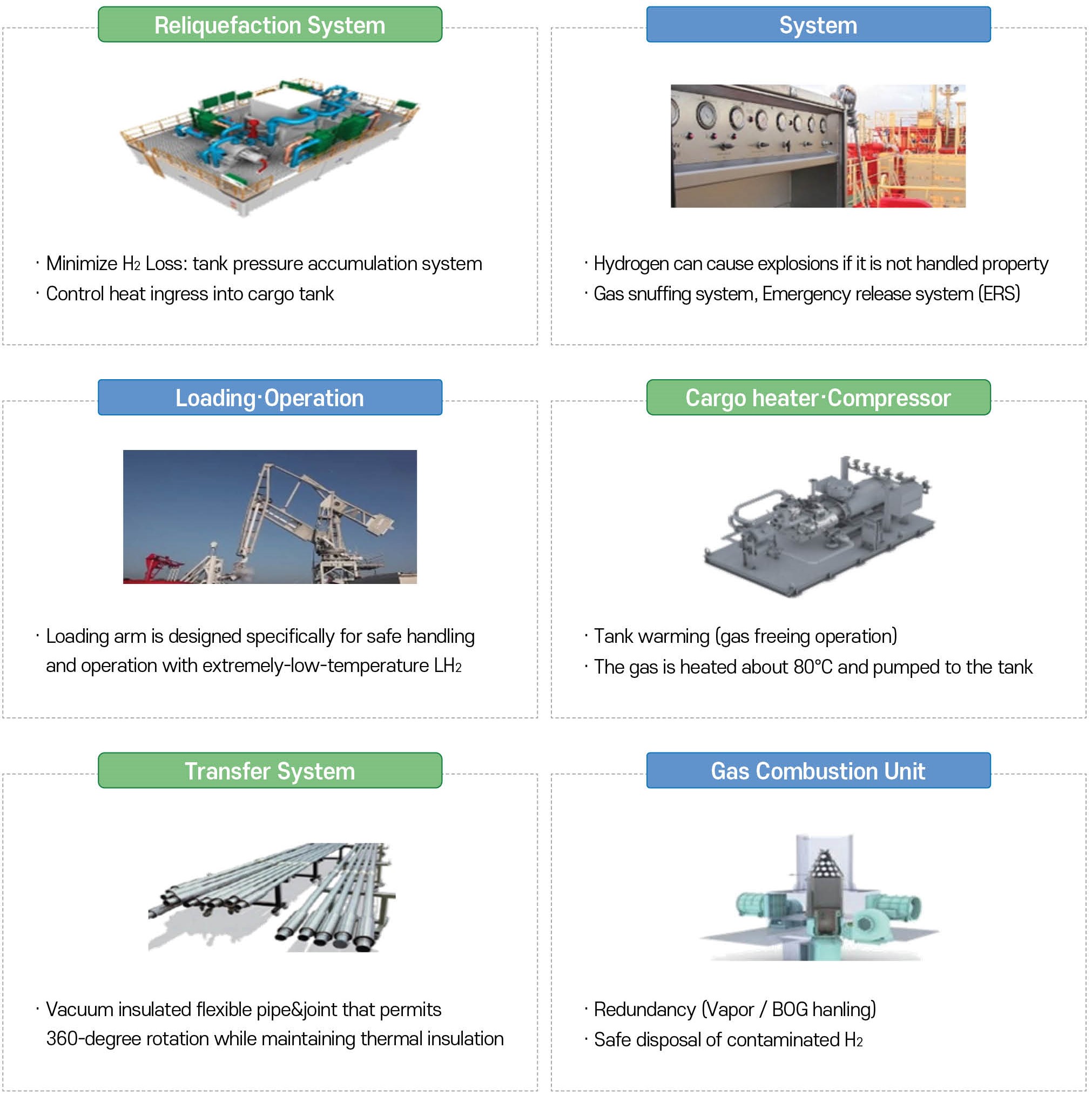

Bunkering System

The bunkering system is a technology that safely and efficiently supplies hydrogen to ships, incorporating the latest advancements in automation and remote control functions. Liquid hydrogen bunkering technology is still in the development stage, and the related component technologies are as follows.

| Emergency Shutdown Systems (ESD) | To ensure rapid shutdown in case of any abnormal situations during the bunkering process, safety valves and automatic shut-off systems should be installed to promptly halt the supply. |

|---|---|

| Hose & Coupling System | The hoses and couplings used to transfer liquid hydrogen to the carrier must be made of materials that can withstand cryogenic temperatures and maintain excellent sealing performance. Additionally, they should be easy and quick to connect and disconnect. |

| Control & Monitoring System | For the safe refueling of liquid hydrogen, the temperature and pressure during the refueling process must be monitored in real-time. This ensures that the hydrogen remains securely sealed, preventing accidents due to leaks or overpressure. Furthermore, the bunkering process should be managed through an automated remote control system, with all operations being monitored and controlled centrally. |

| Boil-off Handling (BOH) System | Since a significant amount of Boil-Off Gas (BOG) can be generated during the bunkering process, measures must be taken to minimize the impact of potential safety incidents. |

BOG handling system

Handling Boil-Off Gas (BOG) is one of the critical technical challenges for liquid hydrogen carriers. BOG refers to the hydrogen gas that gradually vaporizes from the liquid hydrogen in the storage tanks. Efficiently managing and utilizing BOG is crucial for enhancing safety and minimizing energy loss during transportation. The following technologies can be applied to address BOG handling:

| Re-liquefaction Systems | The re-liquefaction system is a technology that converts the generated BOG back into a liquid state. This system uses heat exchangers and compressors to cool the hydrogen gas and re-liquefy it within the temperature and pressure range of liquid hydrogen. While this technology is very effective in improving energy efficiency and minimizing hydrogen loss, it is expensive and complicates the system. |

|---|---|

| Utilizing BOG as Fuel | BOG can be used as fuel for the ship's propulsion or power generation systems. This method is energyefficient as it allows direct utilization of BOG without the need for re-liquefaction. In other words, BOG can be used to generate electricity or provide propulsion through hydrogen-fuelled power system installed on the ship. This concept is similar to the DFDE (Dual Fuel Diesel Electric) system used in LNG carriers. However, unlike LNG carriers that use dual-fuel generators/ engines, liquid hydrogen carriers can use fuel cells, hydrogen engines, or hydrogen turbines as power sources since hydrogen is the primary fuel. |

| Pressure Management | The pressure in the tanks can be adjusted to manage the amount of BOG generated. By reducing or maintaining the pressure at appropriate levels, the vaporization of hydrogen can be minimized. |

| GCU (Gas Combustion Unit) | In case of safety requirements, it may be necessary to burn BOG through the GCU. The capacity of the GCU must be sufficient to consume the generated BOG, and this must be verified. From this perspective, periods of low-speed maneuvering and/or periods without BOG consumption due to ship propulsion or other operations must be taken into account. |

IMO Regulations

In November 2016, during the 97th MSC meeting, the document MSC. 420 (97) 'Interim Recommendations for Carriage of Liquefied Hydrogen in Bulk' was adopted. This document serves as an interim standard specifically applicable to the world's first 1.25k-class liquefied hydrogen carrier, 'Suiso Frontier.' In July 2021, during the 104th MSC meeting, Japan proposed an amendment to the recommendation to accommodate the transportation of large volumes of liquefiedhydrogen. Subsequently, at the 9th CCC meeting in 2023, an agreement was reached on the draft amendment of the interim recommendations, and this document is scheduled to be submitted to the MSC. (The 108th IMO MSC meeting is scheduled to be held from May 15 to 24, 2024.)

Conclusions

In South Korea, there is a policy for introducing green and blue hydrogen via liquid hydrogen carriers. To meet the increasing demands for the hydrogen in S. Korea, Korea Gas Corporation (KOGAS) announced plans to establish infrastructure for importing 100,000 tons of liquid hydrogen from overseas by 2029. Additionally, in November of last year, the government unveiled the "K-Shipbuilding Next- Generation Leader Strategy," which includes a portfolio for securing core technologies for liquid hydrogen carriers as part of future low-carbon ship technologies.

However, there are still many technical challenges to be addressed for liquid hydrogen carriers. Overcoming these challenges will require government support and international technological cooperation for the long-term. Moreover, establishing international regulations will be crucial for verifying safety and enhancing reliability.

Korean Register has been engaged in research and development related to liquid hydrogen carriers for many years, steadily improving its technological capabilities. And our KR plans to continue its efforts to solve the technical challenges associated with key technologies of liquid hydrogen carriers and contribute to the transition of the ecosystem towards the hydrogen industry.

Key Technologies Related to Liquid Hydrogen Carriers

※ Source

1. International Energy Agency (IEA). ‘Energy technology perspectives’ (Jan. 2023)

2. Kim, K., et al. ‘Economic study of hybrid power system using boil-off hydrogen for liquid hydrogen carriers’ International

Journal of Hydrogen Energy 61 (April 2024)

3. Press Release, "Leading the World with the 'Next-Generation K-Ship Strategy'" (Nov. 2023)

4. Ministry of Oceans and Fisheries & KMC, "International Maritime Decarbonization Trends" (Nov. 2023)