Insights

KR Decarbonization Magazine

VOL.05 | Winter 2023

The Prospect of Ammonia-fueled Ships and Challenges for Commercialization

CHOI Wooseok, Principal Surveyor of KR Machinery Rule Development Team |

Rather than doubting the feasibility

|

The Prospect of Ammonia-fueled Ships

When I first encountered ammonia as a zero-carbon fuel in 2018, I had doubts about its feasibility for technical reasons due to its poor combustion characteristics, and for safety reasons due to its toxicity. I wasn't sure that those challenges could be overcome. However, the limited options for achieving IMO's carbon reduction targets have since prompted the push for commercialization of ammonia-fueled ships.

Multiple engine manufacturers are nearing completion of the development of ammonia fuel engines and their commercialization is expected in 2025. The IMO is rapidly progressing the development of ship safety provisions and is planning to implement an interim guideline in 2025.

Ship owners should consider using ammonia as a fuel, but uncertainties such as the economics and safety of ammonia fuel, availability of fuel supply, and related regulations add to the complexity of ship owners' decision making. However, looking at recent trends and the predictions of the international community, there is a trend towards resolving the uncertainty of ammonia as a fuel.

· Economics

LNG-fueled ships, due to their fuel storage tanks and fuel supply facilities, currently command the highest new construction price of all alternative fueled ships, followed by ammonia-fueled ships and methanol-fueled ships. As for the operating costs required, fuel costs and, additionally, regulatory costs due to environmental regulations such as carbon taxes must be considered. As regulations continue to be strengthened, these costs will increase. Fossil fuels, currently used in most ships, benefit from lower fuel prices, but in the future, green fuels such as biofuels or e-fuels will be competitive due to increasing regulatory costs. The predicted future price of fuel varies depending on the data, but considering the average value of each predicted price, green ammonia is expected to be the most dominant of the green fuels.

According to KR's analysis of the economic feasibility of alternative fuels for mid to large-sized ships (although the analysis does contain some uncertain factors), LNG-fueled ships are the most economical when considering both new construction prices and operating costs, followed by ammonia-fueled ships. Since ammonia-fueled ships have not yet been commercialized, it is expected that they will be able to achieve greater competitiveness if sufficient orders for ammonia-fueled ships and bunkering infrastructure are realized.

· Safety

To ensure the safety of ammonia-fueled ships, KR conducted a risk analysis and joint research with the industry for ammonia toxicity, and also studied cases of land-based ammonia plants alongside safe ammonia concentration standards applied to the workplace. Based on this study, an agenda document proposing safety principles and safety requirements for ammonia-fueled ships was submitted to the IMO and this document is now being used to develop the industry safety standards for ammonia-fueled ships.

Since ammonia can pose a fatal risk to human health even at low concentrations, it is necessary to determine the ammonia concentration level that is harmless to the human body and take safety measures to prevent crew members from being exposed to concentrations exceeding this. Anticipated sources of release within the ammonia fuel system can be identified and technology exists that is able to abate the concentration of released ammonia within limits.

In addition, in engine rooms where there is a high risk of gas leakage, the fuel supply pipe is composed of a double walled pipe. Any gas leakage in the engine room can then be prevented by detecting gas leakage within the double pipe system and activating fuel shutdown systems. This is a safety concept that has been applied to LNG-fueled ships for a long time, and the safety of gas leak prevention within the engine room can be regarded as verified.

Accommodation spaces are isolated from toxic areas, and any sources of gas release such as ventilation outlets and fuel pipe vent outlets in gas hazardous areas are provided with ammonia treatment systems to ensure safety by reducing the ammonia concentration to an allowable concentration.

In an emergency situation such as a fire, it is not realistic to dispose of huge amounts of ammonia gas released from the pressure relief valves of fuel tanks, so a safe haven onboard with safety measures for crew members is provided.

In addition, in order to ensure the safety of crew members, the human element such as management and operating procedures of ammonia facilities are important in addition to the ship safety system. Therefore, the training of seafarers is an important issue, and it is expected that additional requirements for ammonia fuel will be developed based on IMO's STCW Code A-V/3 (training requirements for seafarers working on IGF ships).

The Challenges to Commercialization for Ammonia-fueled Ships

Although the industry and regulatory bodies are making great efforts to use ammonia as a fuel for ships, there are many challenges that must be resolved for the commercialization of ammonia-fueled ships. At this point, I would like to suggest a way forward to address the following challenges of operating ammonia-fueled ships.

· Social License

Social consensus and the efforts of various stakeholders are needed to resolve concerns about community sensitivity, crew safety, and port safety due to the toxicity of ammonia. In order for ammonia fuel to be socially accepted, efforts must be made to share the justification of ammonia fuel for GHG reduction and to explain its safety by utilizing the verified safety records of existing onshore facilities such as ammonia terminal facilities. The international community should also share the experiences of first mover countries that have already introduced ammonia-fueled ships.

· Ship Safety Regulations and Port Regulations

At the 9ᵗʰ meeting of the CCC held in September this year, three draft Interim Guidelines were proposed, and based on these, there was intensive discussion on safety regarding the toxicity of ammonia. As a result, a consensus was almost reached on the safety principles (ammonia leak scenario, toxic concentration criteria for crew safety, etc.) that form the basis for safety provision development. The corresponding group during the session will develop a high-maturity draft, with the final draft expected to be developed at the 10ᵗʰ CCC.

In order to commercialize, in addition to ship safety provision, port regulations must be established in a timely manner to enable ship entry and bunkering. To achieve this, communication and collaboration between flag state and port authority is necessary. In addition, unlike ship safety regulations, port regulations are implemented in each country, experiences should therefore be shared to build best practice and international organizations such as IAPH and SGMF should provide guidelines for safe port entry and bunkering.

· Availability of Fuel and Scalability of Infrastructure

Currently, production costs are high because the demand and production technology for green ammonia are not yet mature, but production costs are expected to decrease as production efficiency and technology develop due to an increase in supply. It is certain that demand for green ammonia will expand not only for ship fuel but also for power generation and hydrogen transportation, and as a result, production volume will increase and supply infrastructure will also expand. In addition, if governments implement a policy to help bunkering operators, and along with shipping companies they receive financial support, the operation of ammonia-fueled ships and the construction of bunkering infrastructure will accelerate.

· Education and Qualifications of Seafarers

Education and qualifications are critical to ensure the safety of crew members. Especially when you consider that most accidents at existing industrial ammonia sites are caused by the human element such as poor maintenance, poor driving, and non-compliance with safety procedures rather than safety standards or technical problems. Requirements for the training and qualifications of seafarers are covered in the STCW Code. With the adoption of the IGF Code at the 95ᵗʰ MSC, IMO revised the STCW Code and added the training and qualification requirements for seafarers working on IGF ships as A-V/3. STCW Code A-V/3 is not limited to LNG and considers all possible low flash point and gaseous fuels, so it also addresses toxicity. IMO should prioritize the development of crew training and qualification requirements for ammonia-fueled ships based on the STCW Code A-V/3 and ensure that training requirements are prepared in line with the implementation of the ammonia-fueled ship interim guidelines.

· Various Stakeholders

The commercialization of ammonia-fueled ships involves various stakeholders, including regulatory bodies (flag state and port authority), ship owners, shipyards, engine manufacturers, and fuel suppliers. Communication and collaboration among stakeholders are important. Additionally, in order to elicit active implementation commitment and investment from these stakeholders, solutions to uncertain issues such as access to capital, regulation, and sustainability must be presented. Institutional policies such as green shipping corridors could motivate stakeholders to promote the rapid establishment of infrastructure for ammonia-fueled ships. Through green shipping corridors, government will be able to provide incentives and financial support for the operation of ammonia-fueled ships and fuel supply infrastructure and establish port and bunkering regulations.

Preparing for the Era of Ammonia-fueled Ships

Rather than having doubts about the feasibility of ammonia-fueled ships, the international community is identifying barriers to the commercialization of ammonia-fueled ships and discussing ways to resolve these. The IMO is developing safety requirements by considering all possible risk scenarios to protect crews from the toxicity of ammonia, and the industry is accelerating the development of effective safety equipment for ammonia fuel. Some first movers are conducting pilot projects for ammonia-fueled ships aiming to operate in 2025. Singapore, a bunkering hub, and many other countries, are preparing to build ammonia bunkering infrastructure. The era of ammonia-fueled ships is fast approaching and now is the time for us to prepare for ammonia-fueled ships.

Methanol as a Marine Fuel

Prof. Youngsub Lim, Dept. of Naval Arch. and Ocean Eng. |

While safety precautions are needed,

|

Accelerating climate change has brought about huge changes in the shipping industry. Various alternative fuels are rising for the reduction of GHG (greenhouse gas) emissions, and currently Methanol is receiving great attention as an environmentally-friendly alternative fuel. The main reasons for the current attention to Methanol are as follows:

❶ Green Methanol having low GHG emissions intensity, such as bio-Methanol and e-Methanol, can be produced and supplied.

❷ Methanol is a liquid at atmospheric pressure and temperature, so the existing facilities and infrastructures can be used without major modifications.

❸ Methanol engines have high TRL levels, so Methanolfueled ships are already viable commercially.

On the other hand, Methanol is a flammable and toxic material, so it should be handled carefully, and the required systems are not identical to LNG-fueled ships. This article aims to describe the characteristics of Methanol as a next-generation alternative fuel for ships and deliver key differences between Methanol and other fuels.

Blue Methanol and Green Methanol

The GHG emissions intensity of Methanol has a wide a range of values depending on feedstocks and production methods. The TtW (Tank-to-Wake) GHG emissions intensity of Methanol is lower than that of fossil fuels. If Methanol is produced from fossil fuels such as natural gas, however, the WtW (Well-to-Wake) GHG emissions intensity, including the production of Methanol, is 100.4 gCO2eq/MJ, which is even higher than that of HFO (Heavy Fuel Oil), as shown in Table 1. That is, Methanol produced from fossil fuels cannot be an environmentally-friendly alternative fuel.

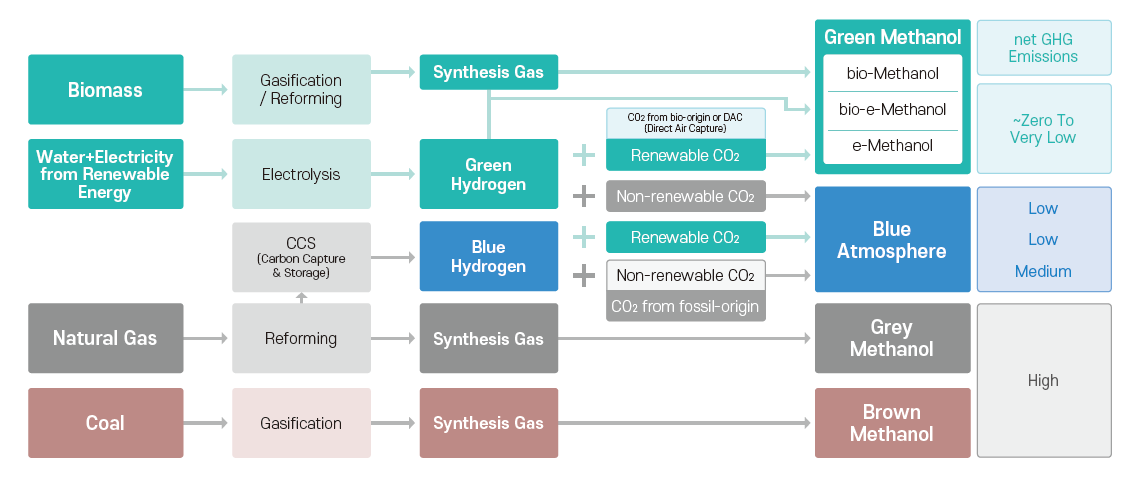

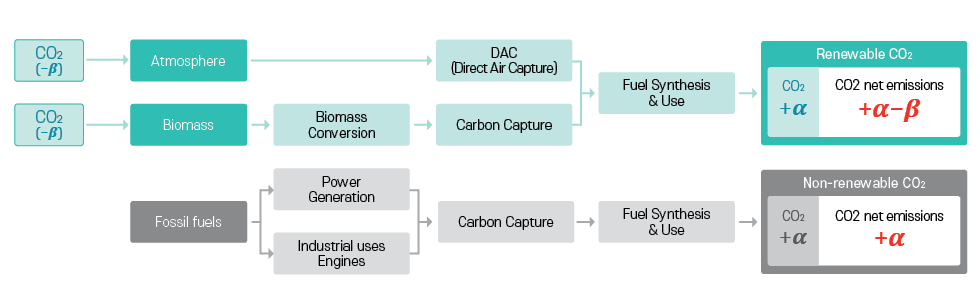

As for Hydrogen, a color classification can be applied according to the production pathway (Fig. 1). Among them, Blue and Green Methanol have lower GHG emissions intensity compared to Methanol from fossil fuels. Green Methanol can be classified into bio-Methanol and e-Methanol. Bio-Methanol refers to Methanol produced from biomass, absorbing CO₂ for growth. E-Methanol refers to Methanol produced by synthesizing renewable CO₂ and Green Hydrogen obtained by electrolyzing water through renewable energy. It should be noted that Methanol produced from non-renewable CO₂ may not be admitted as Green Methanol even when it is synthesized with Green Hydrogen, because the WtW GHG emissions intensity of Methanol produced from non-renewable CO₂ may not be low enough to satisfy the threshold.

In July 2023, MEPC80 selected the concept of a threshold for bio-fuels, so now only bio-fuels reducing more than 65% of WtW GHG intensity can be admitted as a bio-fuel, compared to the WtW GHG intensity of IMO fossil fuel reference, 94 gCO2eq/MJ. In other words, only fuels having a WtW GHG emissions intensity lower than 32.9 gCO2eq/MJ can be admitted as bio-fuels. The discussions for e-fuels are not concluded yet, but when checking the specifications for synthetic fuels in RFNBO (Renewable Fuel of Non-Biological Origin) in FuelEU maritime/REDII, it requires at least 70% reduction of WtW GHG emissions intensity compared to the intensity of the reference fossil fuel. If IMO also adopts the same threshold of 70% reduction for e-fuels, only synthetic fuels having WtW GHG intensity lower than 28.2 gCO2eq/MJ will be able to be admitted as an e-fuel.

If Methanol is synthesized from Green Hydrogen and non-renewable CO₂ or Blue Hydrogen and renewable CO₂, it can be classified as Blue Methanol. Blue Methanol cannot satisfy the threshold WtW GHG intensity required for Green Methanol, but has lower GHG intensity than Grey Methanol. Because the production capacity of Green Methanol is not enough to meet worldwide needs yet, mixed use of Blue/Green Methanol with Grey Methanol is expected in the future, to satisfy the target of GHG reduction.

WtW GHG Emissions Intensity of Various Fuels for Ships (Based on REDII/FuelEU Maritime)

LHV: Lower Heating Value; ICE: Internal Combustion Engine; DFMS: Dual Fuel Medium Speed;DFSS: Dual Fuel Slow Speed; OPS: On-shore Power Supply; ILUC: Indirect Land

Color Classification Based on Methanol Production Pathway

Concept of Renewable and Non-renewable CO₂

Methanol Engines and Storage

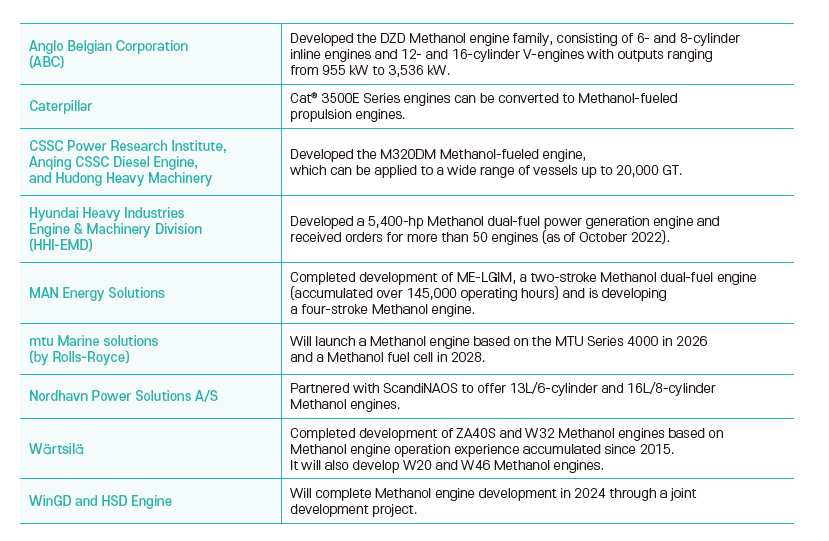

Currently, major engine manufacturers are developing, or have developed, Methanol dual-fuel engines (Table 2). Clarksons Research Services (CRS) reported that 43 Methanol-fueled vessels and 22 Methanol-ready ships were ordered in 2022.

Methanol is a volatile liquid having a boiling point of 64.7°C at atmospheric pressure. It exists as a stable liquid at atmospheric temperature, so there is no need to use low-temperature steel. However, it can be corrosive to some materials, so careful consideration must be given to material selection for tanks and pipes, seals, and other components. The special paint applied to the cargo handling system for a chemical tanker can be also applied to a methanol fuel tank, and then the methanol fuel tank can be manufactured with general shipbuilding steels (AH grade, A grade, etc.). When coating the tank with zinc silicate, the outer structure and the inside of the tank must have flat surfaces without sharp edges. For the special coating, it is important that no support member should be located inside the tank, and outfitting should be minimized for access to the cargo tank.

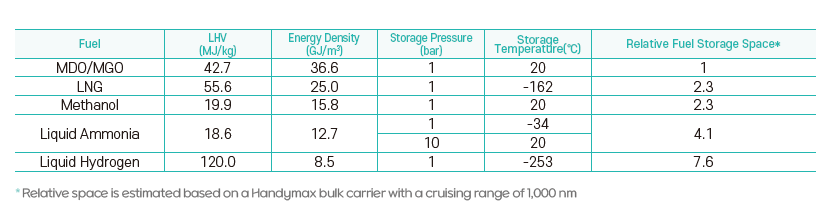

The energy density of Methanol is lower than that of LNG, but there is no additional requirement for cryogenic insulation and bottom space can be used. Accordingly, the relative size of fuel storage space for Methanol is estimated similar to the required space for LNG, which is around 2.3 times larger than that of MDO/MGO (Table 3) even considering cofferdam. This is about half of the required fuel storage space for liquid Ammonia, and ~30% of the space required for liquid Hydrogen. Several literatures reported that the cargo capacity would be reduced by 1.5 – 4.0 % when a ship using HFO as a fuel is converted to a Methanol-fueled ship. To reduce the loss, it is necessary to prepare the structural elements and systems for Methanol conversion.

The Status of Methanol Engine by Engine Developers

Characteristics of Marine Fuels for Storage

Hazards and Safety of Methanol

Methanol is a corrosive, flammable, and toxic substance, requiring very careful handling. Methanol can be absorbed into the body through ingestion, inhalation, and skin contact. Once absorbed, Methanol is oxidized and changed to Formaldehyde, which becomes Formic Acid by alcohol dehydrogenase, and is finally oxidized and decomposed to water and Carbon Dioxide. However, the decomposition rate of Methanol is very slow, leading to the accumulation of toxic substances such as Formaldehyde in the body, and consequently damage to the human body. The incomplete combustion of Methanol may also form Formaldehyde. Formaldehyde is distributed to various tissues of the body, including cerebrospinal fluid, blood, and urine, and is especially damaging when it is absorbed into the ocular and vitreous humor fluid. It causes atrophy of the optic nerve and retina, leading to blindness. According to the standard of NIOSH (US National Institute for Occupational Safety & Health), the TWA(Time Weighted Average) exposure limit for Methanol is 200 ppm and the STEL (Short-Term Exposure Limit) is 250 ppm for a one-day work period.

To prevent accidents, a Methanol fuel tank should be sealed and isolated from heat and ignition sources. The fuel tank must be electrically grounded, and equipped with spark/explosion-proof equipment, ventilation, and exhaust systems. It should be used outdoors or in an area with ventilation systems and personal protective equipment should be worn if direct contact is required. If swallowed, one should wash the mouth and seek immediate medical attention. If Methanol is in contact with skin or hair, one should immediately take off all contaminated clothing and flush the skin with water. Contaminated clothing should be washed before reuse. When inhaled, one should move to a place with fresh air and take a rest. Fomepizole (or 4-Methylpyrazole) is available for the treatment of Methanol poisoning in the WHO Essential Medicines List.

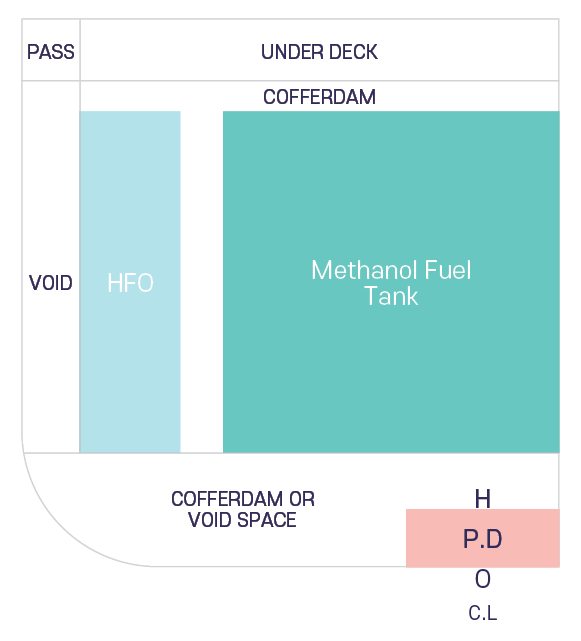

For Methanol-fueled ships, the IMO’s Interim Guidelines for the Safety of Ships Using Methyl/Ethyl Alcohol as Fuel (MSC.1/Circular.1621) is applied and KR applies Appendix 5: Requirement for Ships Using Methyl/Ethyl Alcohol As Fuel in KR Rules for Ships Using Low-flashpoint Fuels. The regulations are based on the IGF Code, but there are differences with LNG because Methanol has clearly different characteristics. Since Methanol exists as a liquid at atmospheric temperature and pressure, cryogenic insulation and a secondary barrier designed to prevent brittle fracture are not required. As a result, unlike LNG or Ammonia fuel tanks, Methanol tanks can be deployed as integral fuel tanks where part of the hull structure belongs to the tank. However, due to the toxicity, a protective cofferdam is required around the Methanol tank (Fig. 3) and should be inerted at all times during normal operation. Fuel piping that passes through enclosed spaces in the ship should be enclosed in a pipe or duct that is gas and liquid tight. Drip trays should be fitted where leakage and spill may occur, and each tray should be provided with means to safely drain spills or transfer spills to a dedicated holding tank.

Example of Methanol Fuel Tank a Arrangement

Price Estimation for Methanol

The price volatility of alternative fuels is very high depending on the period, regions, and feedstocks, making it difficult to draw comparisons. As of 2021, the estimated price of Grey LNG was around $17.6/GJ, and that of Grey Methanol was around $20/GJ. However, for a certain period of time, the price of LNG increased more than twice that of Grey Methanol.

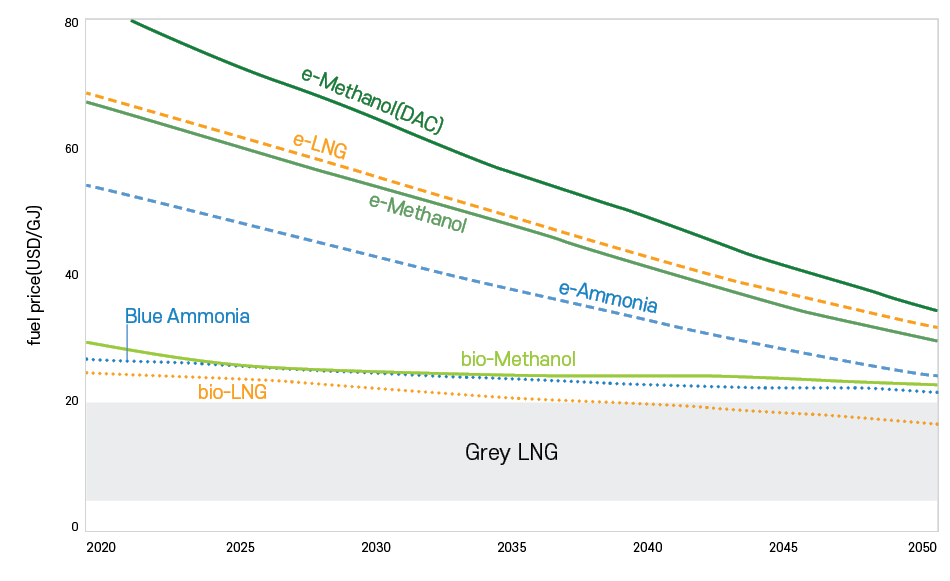

Bio-Methanol can be produced from biomass or MSW (Municipal Solid Waste), and the price is estimated at around $30/GJ, which is relatively low among Green Methanol. On the other hand, the production price of e-Methanol is estimated quite high, at around $66, and the price increases to more than $80/GJ in the case of using carbon dioxide from DAC (Direct Air Capture). The cost of electricity from renewable energy has the most significant impact on the production cost of e-Methanol. By achieving high technology readiness of renewable power generation and water electrolysis in the future, the production cost of e-Methanol is expected to gradually decrease. For bio-Methanol, due to the increased demand for biomass, even with mature technology in the future, the decrease in production cost is not expected to be large. Fig. 4 shows the expected change in fuel price for bio-/e-Methanol and other fuels.

Fuel Price Forecast for bio-/e-LNG, blue/e-Ammonia, and bio-/e-Methanol

Conclusion: Methanol as a Marine Fuel

Methanol is a liquid fuel, so has the advantage of being able to utilize existing liquid storage facilities and infrastructure without major modifications. Methanol engines are already commercialized so Methanol-fueled ships are viable now. Also, Blue Methanol and Green Methanol, having lower GHG intensity, can be produced and used with Grey Methanol to satisfy the regulation for GHG emissions reduction. Currently, the price of bio-Methanol is relatively low, so the demand for bio-Methanol would be high for a considerable period of time. The production cost of e-Methanol would decrease with advanced technologies, then e-Methanol would be able to compete with other alternative fuels.

Methanol is a toxic substance that can be absorbed into the body through ingestion, inhalation, and skin contact, so should be handled very carefully. Distinguished safety regulations such as cofferdams and double-walled pipes need to be applied. Safety education on Methanol for seafarers are not provided sufficiently yet, education and training programs are needed to be prepared.

Outlook for Propulsion Engines in the Era of Multiple Alternative Fuels

KIM Yeongho, Principal Surveyor of KR Technology Business Support Team |

Collaboration:

|

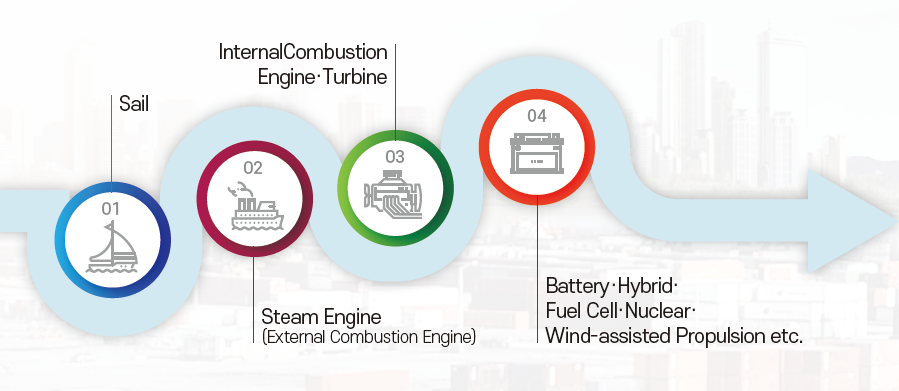

Where is the Engine's Position in the Technical Pathway?

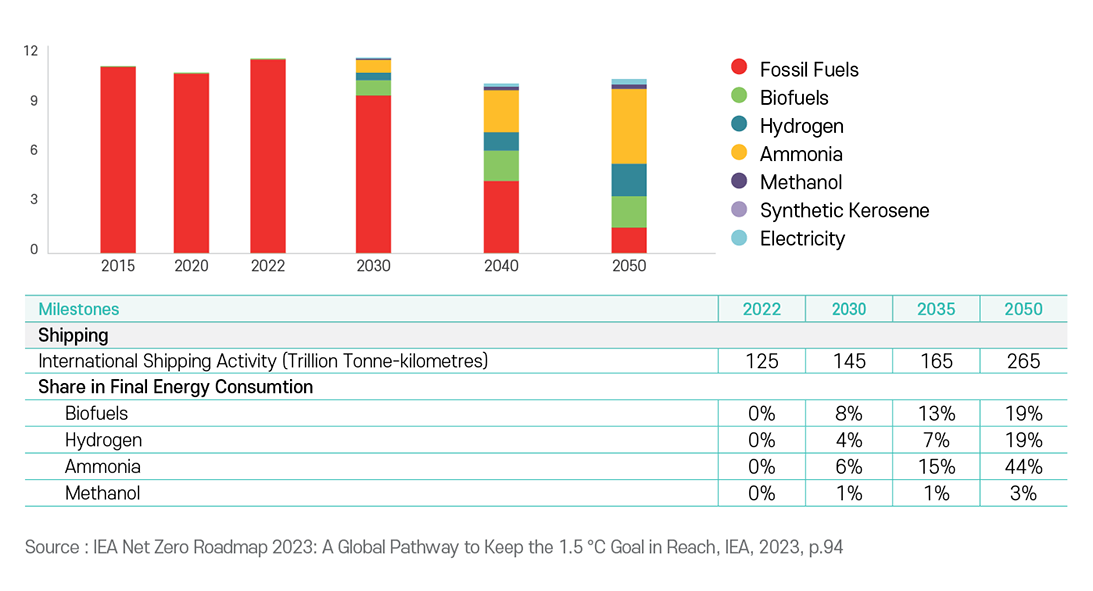

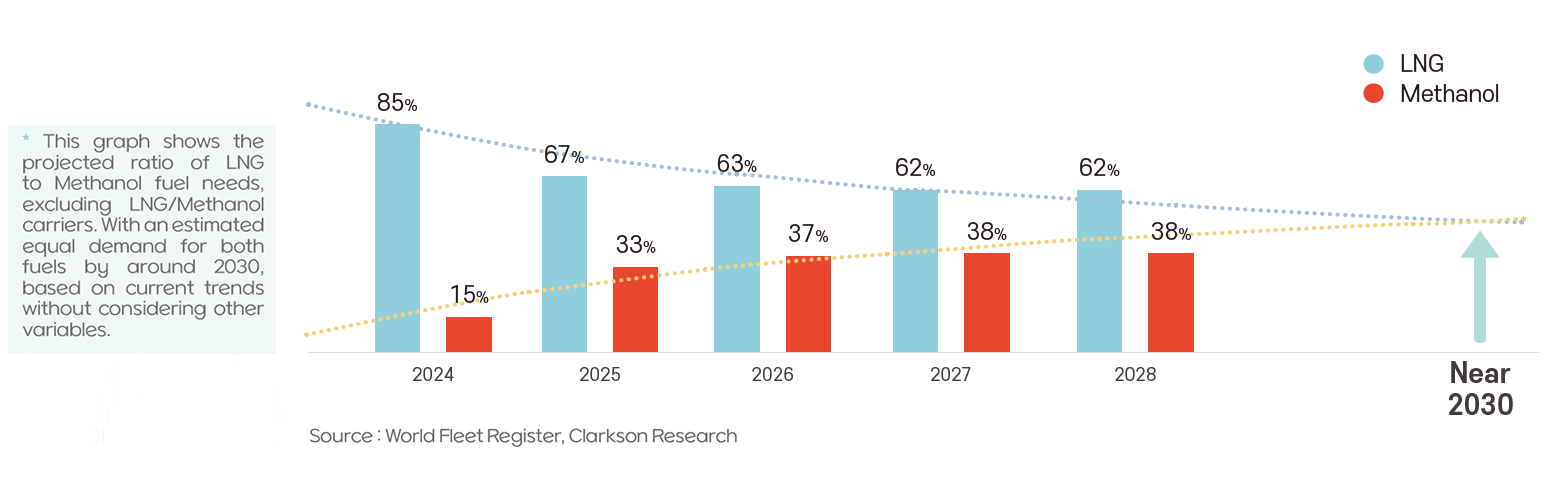

Ship propulsion techniques have continuously evolved through the ages. During the Age of Discovery, ships primarily relied on wind power and sails for propulsion, and following the Industrial Revolution, they evolved to use steam engines and internal combustion engines. Today, a variety of propulsion systems are being applied to ships, including ICEs, electric & hybrid systems, fuel cells, nuclear power and others. In response to the global climate crisis and the drive towards decarbonization, there is also an increasing use of various low-carbon or zero-carbon fuels, along with the use of wind-assisted propulsion systems that improve upon traditional sails. While it’s still uncertain which propulsion method will dominate in the future, we can somewhat predict the direction of engine development based on the outlook for marine fuels. The number of ships using LNG and Methanol as fuel is increasing, and if this trend continues without the adoption of other fuels, the demand for these fuels is expected to equalize by around 2030, based on current ship orders. However, according to various energy forecasts for 2030-2050, including those by the IEA, the proportion of Ammonia, a carbon-free fuel, is expected to exceed that of Methanol. Therefore, the development of ICEs and fuel cells that use Ammonia as fuel is actively underway. Consequently, it’s necessary to understand the technical position and pathway of the engine.

Shipping Energy Consumption Outlook

Expected Quantity of Fuel Needs in Orderbook Except LNGC*

The Evolution of Ship Propulsion Systems

The Beginning of the Decarbonization Era

The maritime industry is facing stringent carbon regulations from organizations like the IMO and the EU to combat global warming. This has led shipowners, shipbuilders, and engine manufacturers to consider alternative fuels for ships from various perspectives. A key point is that these regulations aim to reduce the use of fuels with Life Cycle Assessment (same as Well to Wake, WtW) carbon emissions. Such regulations will gradually induce a shift in the types of Fuel used in Ships. Consequently, changes in ship structures, as well as in propulsion and power generation engines, are necessary. Discussions are ongoing about the need to shift from currently used ICEs to fundamentally different types like fuel cells or nuclear power. However, in the shipbuilding and shipping industries, the role of ICEs, with their proven long-term efficiency and extensive operational experience, are expected to continue for a considerable period. The selection of future fuels and propulsion systems demand a balanced consideration of environmental responsibility, practical feasibility, and the economic factors associated with adopting new technologies. Therefore, the transition to decarbonization is not just a matter of regulatory compliance but also requires a shift in engine lineups focused on reducing carbon footprints. This presents the maritime industry with an opportunity to lead in fulfilling environmental responsibilities and set a precedent for other industries.

Environmental Regulations and the Pathway for Alternative Powered Engines

The EU's 'Fit for 55' legislative package, including the FuelEU Maritime regulation, anticipates significant costs associated with regulations on greenhouse gas emissions from fuel usage on ships over time. According to this regulation, the regulatory costs vary depending on the type of fuel used, and even for the same type of fuel, the timing of cost imposition can differ based on the combustion cycle of the engine. The IMO is also preparing similar regulations as mid-term measures. Recently, new ship orders for alternative fuel propulsion have selected LNG or Methanol as fuels. The contracted construction of Ammonia fuel propulsion ships is also underway, indicating an expected increase in their share. Engine manufacturers are developing alternative fuel engines in line with this decarbonization trend.

The change in the type of engines used in ships is noteworthy. The transition from external combustion engines to ICEs in the past was due to the change from coal to gas/oil as fuel. Subsequently, engine improvements focused on enhancing the performance and efficiency of ICEs. With the drive towards decarbonization, ICEs are being developed to use fuels like LNG, Methanol, and now Ammonia. By 2024-2025, engines using Ammonia as fuel are expected to enter the market. However, amid concerns over the toxicity of Ammonia, ensuring safety in engine usage is one of the most critical issues. Engine manufacturers are paying special attention to these concerns, developing engines based on risk assessments. The engine development phase marks the beginning of a major fuel transition in the maritime industry and a step towards sustainability and environmental responsibility. Accordingly, there is an increasing need for the development of alternative fuel engines, infrastructure development based on the characteristics of each fuel, and the enhancement of training and safety education for crew members.

Expanding the Use of Biodiesel

Since the adoption of oil or gas as marine fuels, factors such as fuel prices, supplies, and environmental regulations have led to an increase in the use of various types of fuels, including Diesel, Heavy oil, Low-sulfur Oil, and LNG. These fuels, particularly suited for high-efficiency ICEs, have led many ships to prefer direct propulsion methods using these engines.

From 2024, starting with the EU, alternative fuels and engines will be necessary to address regulatory costs. However, currently, only 5% of operating ships can use alternative fuels, while 95% are traditional fossil fuel-based ships incapable of using alternative fuels. Suddenly converting 95% of the operating fleet to alternative fuelled ships is impractical. In this context, biodiesel is emerging as an optimal alternative that can be quickly applied. Biodiesel is a drop-in fuel, meaning it can be used with minimal or no modifications to existing infrastructure and engines. Engine manufacturers are advising that engines can operate on various types of bio-oils without significant modifications.

Research continues on the long-term effects of biodiesel on engines, but no issues have been found in short-term use. However, considering the characteristics of biodiesel, proactive measures are needed for potential long-term use issues, such as preferring quick usage over long-term storage of the fuel and shortening engine maintenance periods.

The use of biodiesel is an active measure to reduce the carbon footprint of the maritime sector, aligning with global efforts to combat climate change. Although there are questions about its potential for mass production, an increased use of biodiesel could play a significant role in enhancing the sustainability of the shipping industry.

Alternative Fuels, Engines, and Bunkering

Engines are already utilizing a variety of alternative fuels like LNG, LPG, Ethane, and Methanol. Engine manufacturers seem to be focusing more on improving and developing engines that use LNG, Methanol, and Ammonia as fuels. This is likely because, so far, fuels like LPG/Ethane haven't been widely chosen as ship fuels due to a lack of price advantages, leading to no significant investment in bunkering infrastructure for ships other than those specifically designed for LPG/Ethane. However, in line with the drive towards decarbonization, LNG and Methanol are being bunkered at major ports or are seeing the development of related infrastructure.

In 2023, ships using Green Methanol as fuel began operations, and over 100 more methanol-fueled propulsion ships are expected to enter the market. The increase in methanol propulsion ships signifies the need for at least minimal Methanol bunkering infrastructure at major ports within the next 2-3 years. Although it took about a decade to establish the current LNG bunkering infrastructure, the significant fuel usage of large Methanol-fueled container ships, which have many orders, necessitates a faster development of Methanol infrastructure at major ports compared to LNG. The trend in Ammonia fuel propulsion ship orders would have to be observed around 2024-2025 when engine development is completed, and the speed of setting up bunkering infrastructure will depend on how quickly demand for these ships increases compared to Methanol propulsion ships.

As ships transition from using one fuel type to multiple types based on routes, ports and shipping companies must adapt by developing tailored strategies. These strategies should consider the availability of fuels, their environmental impact, and economic viability.

Managing Alternative Fuel Engines

In the process of developing engines powered by new types of fuels, manufacturers must consider a range of factors. However, forecasting problems that could occur during extended operation is often a complex task. Each fuel possesses distinct characteristics, including boiling point, ignition point, viscosity, and heat generation. These variances lead to different mechanical and thermal stresses within the engine, making it difficult to predict potential long-term issues. For instance, engines that run on LNG fuel have encountered various challenges post-commercialization, and improvements are ongoing for engines using LPG and Methanol. The long-term problems associated with engines running on Ammonia, a fuel still in the development phase, are largely unknown. However, based on previous New engines frequently face issues with their fuel injection systems. Additional common problems include fuel line blockages, challenges with advanced electronic controls, difficulties in integrating new features, and the need for specialized crew training.

Considering these factors, shipping companies must work closely with engine developers and manufacturers. A key strategy in this collaboration is ensuring the availability of spare parts and resources for relieving the issues. Engine developers, particularly those preparing for the era of multiple alternative fuels, may encounter unexpected challenges. The introduction of new engines can lead to both human and material damage, underscoring the importance of industry feedback for continuous engine improvement. This situation necessitates a collaborative effort among shipping companies, classification societies, engine developers, and manufacturers, transcending the usual competitive boundaries.

Outlook and KR's Collaboration

To achieve decarbonization goals, clear signals and investments in the decarbonization of the maritime industry are now necessary, and the market is ready to respond to these developments. Alternative fuel engines are expected to contribute significantly to achieving the IMO's decarbonization targets. Initiatives like the Green Corridor Initiative, which helps governments determine the primary fuel for each route and provide clear industry signals such as subsidies, will clarify the choice of fuel and engines for ships operating on specific routes. However, as a variety of alternative fuels are expected to be used, it is crucial for each stakeholder to monitor the development of engines for different alternative fuels, the status of bunkering infrastructure, and operational issues, and to rapidly establish decarbonization strategies.

After the introduction of engines operating on new fuels, a period of improvement is necessary for long-term stable operation, requiring collaboration among stakeholders to resolve various issues. KR is collaborating with the related industries in various ways as we enter the era of diverse alternative fuel engines. This cooperation will not only lead to technological advancements but also contribute to compliance with environmental regulations, transforming the maritime industry's response to the climate crisis into an opportunity for further advancement.

International Trends and Overview of Green Shipping Corridors

KIM Chongmin, Senior Surveyor of KR System Safety Research Team |

A Green Shipping Corridor examines the economic

|

Net Zero and Shipping Companies

International shipping is responsible for 90% of the world's freight traffic and emits 3% of global emissions, or about 10 billion tonnes of greenhouse gases each year. This is roughly the same as Germany's national carbon emissions, and as a country, shipping is the sixth largest source of greenhouse gas emissions (GHG) globally. The International Maritime Organisation's (IMO) 80ᵗʰ session of the Marine Environment Protection Committee (MEPC 80) reinforced the responsibility of the shipping sector with a 'net zero' declaration. Stakeholders, including the shipping industry and governments, need to make a concerted effort to develop concrete measures to achieve GHG reduction targets.

At the 27ᵗʰ Conference of the Parties to the United Nations Framework Convention on Climate Change (COP 27; '22.11.6-20 in Sharm El Sheikh, EGYPT), the Government of the Republic of Korea agreed to jointly conduct a feasibility study for the establishment of ROK-US Green Shipping Corridors. In addition, the Korean and US governments are jointly studying the feasibility and options for establishing green shipping corridors between major ports in the two countries, including Busan and Tacoma. The study is being conducted by the Mærsk Mc-Kinney Møller Centre in Denmark, a consortium led by the Korean Ministry of Oceans and Fisheries, and The Northwest Seaport Alliance (US).

* MMMC is a NGO, independent research and development centre sponsored by Mærsk shipping company to develop practical greenhouse gas reduction measures related to achieving net zero emissions in the shipping sector.

Busan & Tacoma as Target Ports

for the ROK. vs. U.S.A. Green Shipping Corridors

Source: KR

Green Shipping Corridors

The establishment of green shipping corridors can be defined as the implementation of a green marine fuel 'value chain' by stakeholders such as governments, ports and companies. It started with the ideal of bringing the world's nations together to achieve carbon neutrality, but underneath the surface lies fierce competition between nations for leadership in the shipbuilding, shipping and energy industries.

International Green Shipping Corridors Competition

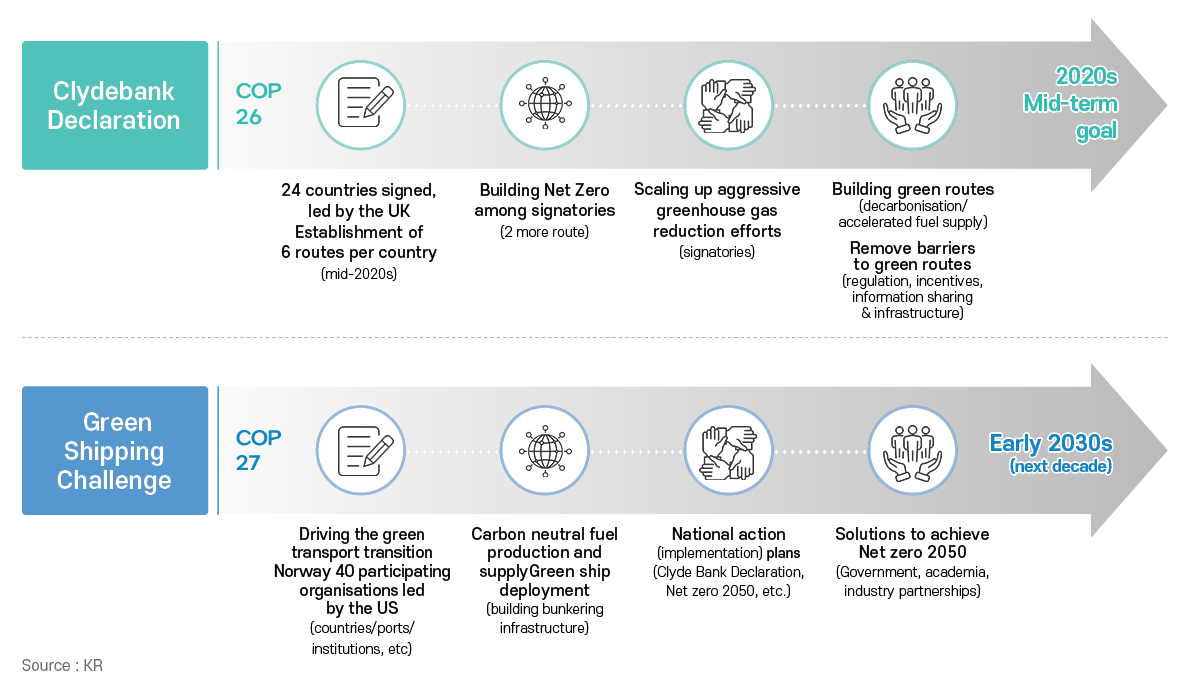

· Clydebank Declation

At COP 26 (31 October - 13 November, in Glasgow, UK), the UK made a commitment to establish 'net zero' shipping routes through the 'Clydebank Declaration'. The 24 signatories to the Clydebank Declaration have agreed to work together to achieve net-zero shipping routes, accelerate decarbonization and remove barriers to achieving GHG reductions.

The target date is the mid-2020s. In particular, signatories are required to establish six green shipping corridors per country by the end of the decade, with signatories encouraged to establish at least two routes between them.

· Green Shipping Challenge

The US Green Shipping Challenge Project at COP 27 relaxed the original Clydebank Declaration target from the mid-20s to the early 2030s. In addition, the project has expanded the scope of participants from the Clydebank Declaration to include 40 countries, ports, and related organizations, bringing together various efforts to achieve net zero.

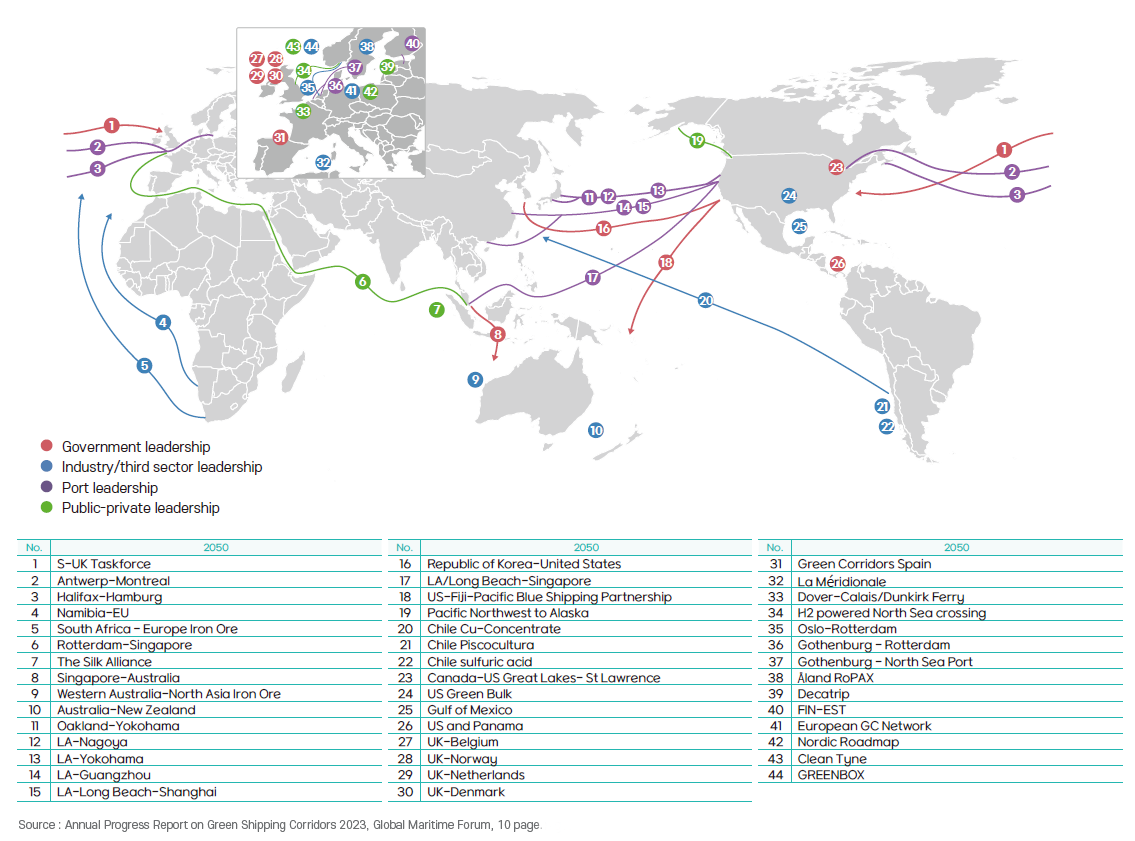

· Status of Green Shipping Corridors

Currently, according to a report by the Global Maritime Forum, 44 projects involving 171 stakeholders are underway, including shipowners and operators, technical organizations, port authorities, fuel suppliers, regulators, classification societies and financial institutions. The Republic of Korea is pursuing a green shipping corridor with the United States.

Green Shipping Corridors Map

Port Readiness Level Indicator for Alternative Fuels for Ships (PRL-AFS)

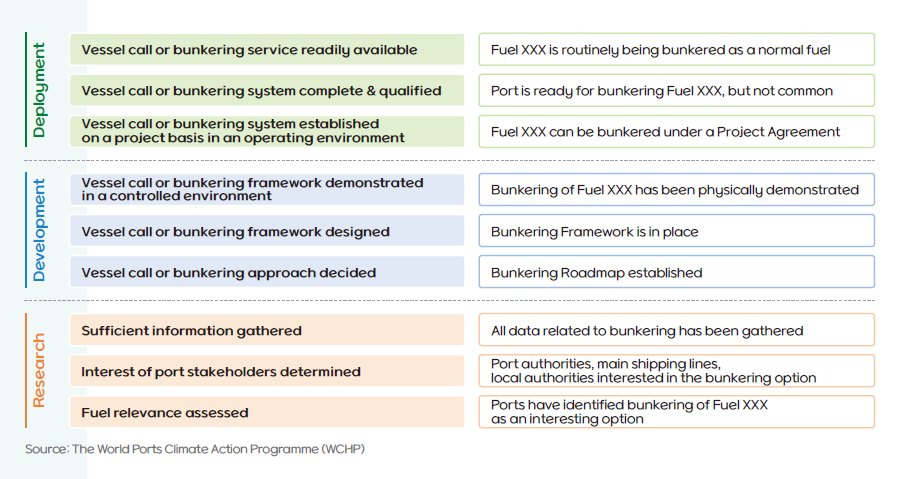

The World Ports Climate Action Program (WCHP) has defined the ‘Port Readiness Level indicator for Alternative Fuels for Ships (PRL-AFS)’ and classified ports into three levels of green fuel supply/use. The three levels are: Research, Development and Deployment. Ports offering berthing or bunkering services can indicate their progress towards the final state of being fully ready to accommodate ships using green alternative fuels with nine levels of detailed indicators.

· Indicators Shipowners Can Use

The shipping industry is exploring alternative fuel technologies to reduce carbon emissions. Shipping and port stakeholders need transparent indicators of green alternative fuel availability, bunkering infrastructure and port capabilities and development plans related to the handling of alternative fuel-powered vessels. The Port Green Fuel Readiness Index can fulfil this role.

· Port Capability Indicators

The port 'PRL-AFS' provides clear guidance on what is required to plan and evidence readiness for alternative fuels at each stage (and is also a standard indicator of the state of port alternative fuel infrastructure). It also provides shipowners with information that can feed into investment decisions on alternative fuel use (e.g., the introduction of cleaner alternative fuel-powered vessels) and discussions about port use.

· Status of Infrastructure Investment Plans

‘PRL-AFS’ provides information on infrastructure investments to help fuel suppliers identify market demand and match supply to meet it.

Regulators can use the ‘PRL-AFS’ to commit to the utilization of alternative fuels within their jurisdiction and assess the impact of projected alternative fuel availability on industry emissions reduction targets.

Governments can use the ‘PRL-AFS’ to provide transparent indicators of local, national, regional and international demand for individual fuels to inform policy and investment decisions..

Classification of PRL-AFS

· Status of 'PRL-AFS' at Domestic Ports

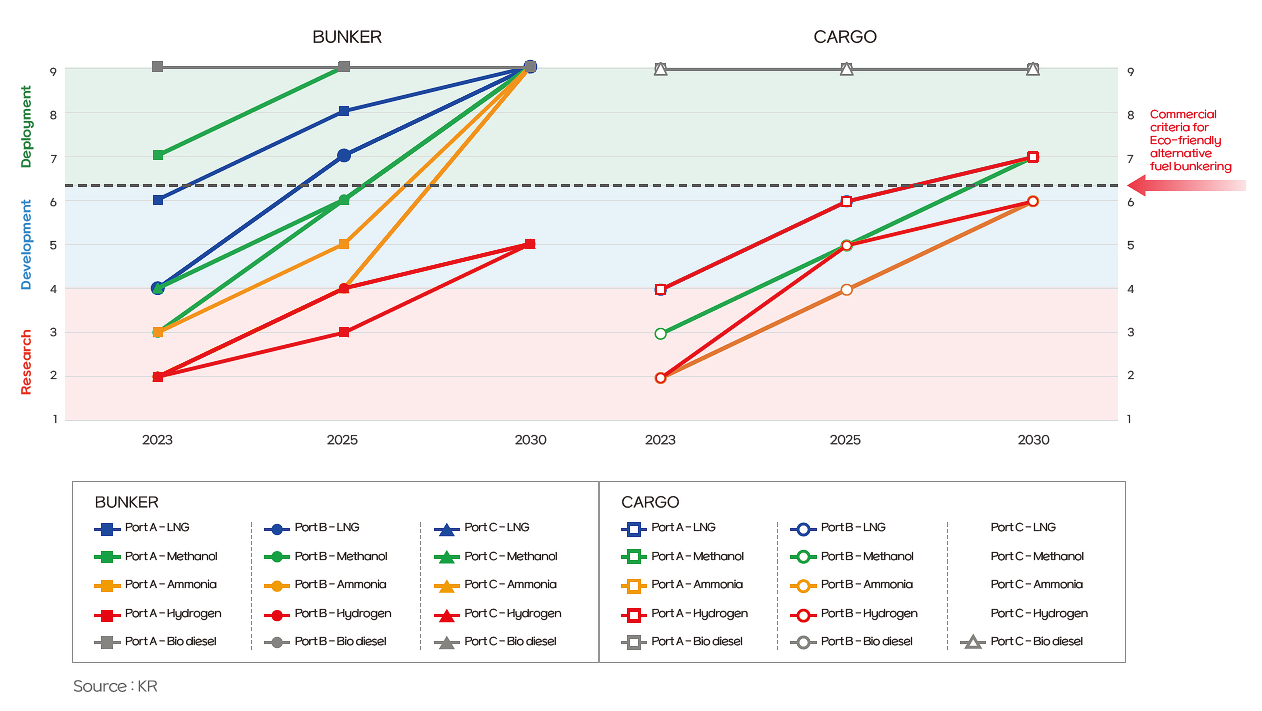

The following figure shows the availability of alternative fuels in the ports based on the 'PRL-AFS' of the three ports (Ports A, B and C). Currently, biodiesel (bio marine fuel) is the most active, showing that it can be bunkered if required. Methanol is also available for bunkering at Port A through a project agreement.

It can be seen that after 2030 bunkering of all fuels, except hydrogen, can be carried out seamlessly in ports.

‘PRL-AFS’ at Domestic Port (2023~2030)

Process for Establishing a Green Shipping Corridor

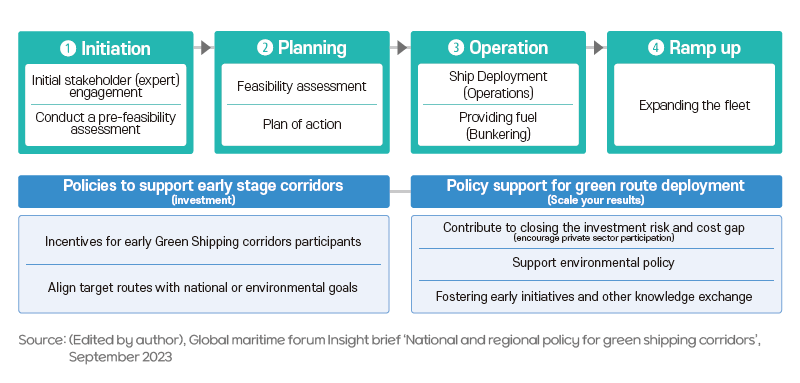

A Green Shipping Corridor consists of four steps : Initiation, Planning, Operation, and Finalization. The Initiation and Planning phases require initial supportive policies to attract investment. The 'Operation' and 'Finalization' phases require policy support to expand the performance of established green shipping routes.

In the Initiation Phase, a 'pre-feasibility assessment' is carried out with the participation of experts to select suitable routes and fuels. In the Planning Phase, the feasibility (economic) assessment and its implementation plan are refined to align the scale of incentives for early participants and the targeted routes with shipping lines, NGOs, or national environmental goals. Securing 'economies of scale' at the operational level is essential to reduce investment costs for shipping companies and stabilize the supply of alternative fuels. To this end, information exchange to increase private participation and the development of policies to ensure economic benefits should be promoted.

Finally, we need to encourage the continued expansion of the fleet to increase performance on green shipping routes.

Procedure for Building a Green Shipping Corridors

KR's role

The establishment of green shipping routes has received a lot of attention from the International Maritime Organisation (IMO) and the European Union (EU) as it is the most efficient project to reduce the technical, economic and policy gaps for greenhouse gas reduction in shipping.

As part of the pre-feasibility assessment for the establishment of the Korea-US Green Shipping Corridor, the Korean Register has completed work on the preparation of the 'Port Green Fuel Advance Readiness (PRL-AFS)' and bunkering status of the target ports. We will continue to support the project for further refinement and development of green shipping routes.